Latest Blogs

IT Support

Ramsha Khan

Feb 12, 2026

What is an IT help desk? How will IT help Companies in 2026

Read More...

What is an IT help desk? How will IT help Companies in ...

In 2026, businesses are navigating a complex digital landscape. From cloud computing to AI-driven analytics, technology powers almost every aspect of operations. But as IT systems become more sophisticated, the need for reliable tech support grows. You can have an in-house IT team to handle everything, or you can have an outsourced IT help Desk team.

However, according to a LinkedIn study, the turnover rate of IT professionals in the software and technology industry has remained high at about 13.2% or higher for years. And if we’re talking about costs, just in the Northern US, a help desk agent remains in the office for about 2 years, but replacing them can cost around $12,000.

So, what are you to do in a position like this?

You can choose to go ‘the IT help desk outsourcing way’.

Not only is this a cost-effective solution, but a great partnership can go a long way, and both teams can benefit from it for years.

Whether you are a small startup or a large enterprise, understanding what an IT help desk is? and how it can benefit your business is critical for staying competitive. Let’s explore the role of IT help desks, their key functions, and why outsourcing IT services is becoming the norm for companies worldwide.

An IT help desk is a centralized point of contact within an organization for resolving technology-related issues. Think of it as the “frontline” of IT support, handling everything from troubleshooting software problems to assisting employees with network access.

If we answer simply, what does an IT help desk do? We can say that it ensures that technology-related challenges don’t slow down business operations. A well-run IT helpdesk doesn’t just fix issues; it anticipates them, helping teams work efficiently and securely.

Some fundamental points about an IT help desk include:

By understanding the basics, companies can appreciate why an IT help desk is essential.

As mentioned above, an IT helpdesk is the central point of contact for all technology-related queries and issue resolution within an organization. The core functions of an IT help desk revolve around ensuring smooth IT operations.

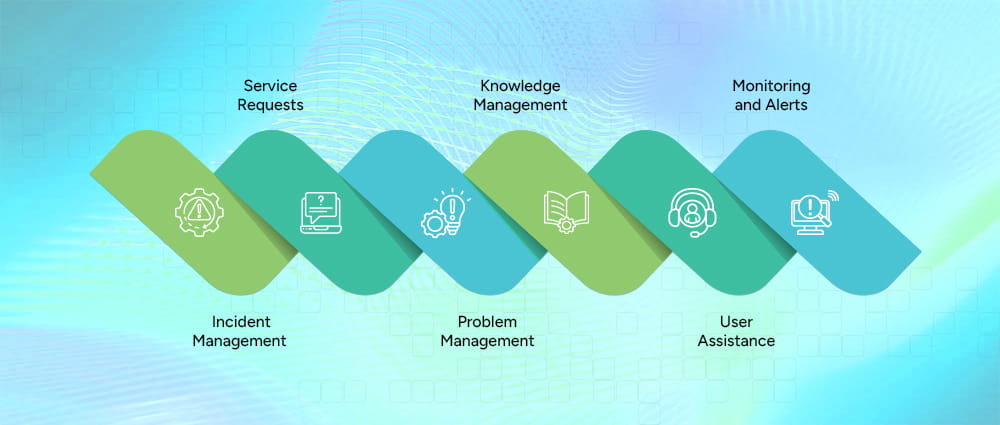

Some of the main functions of an IT help desk are:

In the event of an incident, IT teams quickly identify and resolve user-reported issues to restore normal operations as fast as possible, reducing employee downtime and business disruptions.

There can be many employee requests for hardware or software. They send these service requests to the IT team, which manages everyday IT requests, including password resets, software installations, system access, and hardware upgrades, ensuring employees have what they need to work efficiently.

In this, your IT help desk services analyze recurring or complex issues to find the root cause and apply permanent fixes, helping prevent the same problems from happening again.

Through knowledge management, the team builds and maintains a centralized library of solutions, FAQs, and troubleshooting guides, enabling faster resolution of common issues in the future.

Like your customers need customer service, your employees, users, and team also require User Assistance. Your IT helpdesk service is primarily there for this function. They provide timely, real-time support via chat, email, or phone to guide users through technical issues and improve their overall experience.

Your IT service team continuously monitors systems, networks, and applications, sending alerts when potential issues arise so teams can act before failures impact users.

Essentially, an IT help desk fills the gap between technology and users, ensuring business operations stay uninterrupted.

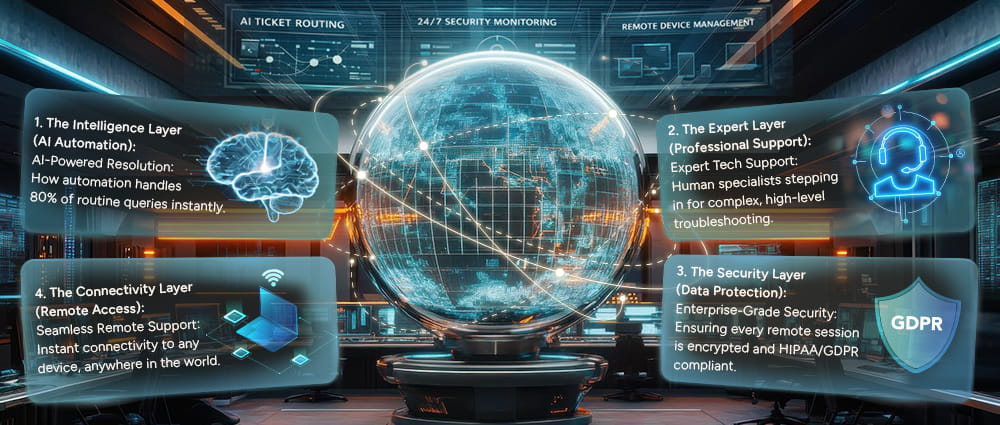

Fundamentally speaking, an IT help desk software is a centralized platform that the IT team uses to manage, track, prioritize, and resolve technical issues reported by employees and users. Modern IT helpdesks rely heavily on specialized software to streamline support. Most IT help desk services use tools and software with the following features:

Efficiently log, track, and prioritize user issues from multiple channels such as email, chats, or web portals. Advanced ticketing systems can actually automatically categorize tickets, assign them to the right technician, and track progress until resolution, ensuring no request is lost or delayed.

AI-powered bots and workflows can handle repetitive tasks, such as password resets, software installations, and basic troubleshooting, freeing human agents to handle complex problems.

Allow users to solve common problems themselves through searchable knowledge bases, FAQs, and step-by-step guides. Self-service portals not only save IT staff time but also increase user satisfaction by providing instant solutions.

You can get easy-to-read reports showing things like how fast issues are being resolved, how many tickets are coming in, and any recurring problems. These insights help IT teams work smarter, improve performance, and fix issues before they become bigger problems.

Connect and work seamlessly with other business software, such as CRM or ERP systems, collaboration tools (Slack, Teams), and monitoring systems.

Provide technical support without physically being on-site, which is essential for distributed or remote teams. Remote access enables IT staff to troubleshoot devices, install updates, or fix configurations securely from anywhere, especially good for outsourced IT services.

Ensure secure handling of sensitive company data and compliance with regulations like GDPR or HIPAA. Features like role-based access, encryption, and audit logs protect information and maintain accountability.

Adapt workflows, ticket forms, dashboards, and automation rules to fit the organization’s needs. Scalable solutions grow with the business, supporting more users, devices, and complex processes as requirements evolve.

With these tools, companies can enhance efficiency, reduce downtime, and deliver consistent IT help desk benefits to employees and customers alike.

Outsourcing IT support is no longer just a cost-saving tactic—it’s a strategic decision for companies aiming to scale and innovate. Here are six reasons why outsourced IT services will be crucial in 2026.

According to studies, IT helpdesk outsourcing has grown rapidly over the past few years, and the global market is expected to jump from around $10 billion in 2024 to $18.3 billion by 2033.

Help desk outsourcing is set to keep growing, with 91% of organizations planning to either maintain (56%) or increase (36%) the work they outsource. This means that the IT help desk outsourcing market has matured, making it easier for businesses to rely on proven external solutions instead of building in-house teams.

This convenience makes outsourcing a smart and attractive choice, and businesses are able to focus on core operations while ensuring seamless IT support.

Maintaining an internal IT team can be expensive due to salaries, training, and infrastructure costs, and well, the turnover rate mentioned above isn’t helping companies scale either.

Outsourcing to lower-cost regions like Asia and Latin America cuts both labor costs and the extra expenses of hiring, training, and keeping in-house staff. Plus, top providers offer flexible pricing, so companies can easily scale services up or down as needed.

Outsourcing IT help desk services allows businesses to convert fixed costs into flexible expenses. Companies pay for services as needed, optimizing budgets without compromising quality.

By 2026, AI and automation will play an even bigger role in IT support. Chatbots, predictive analytics, and AI-driven ticket routing help resolve issues quickly while enhancing the user experience.

One 2025 report by CallMiner CX Landscape found that almost all (96%) customer experience and contact center providers see using AI, including Generative and Agentic AI, as a crucial part of their success strategy.

Automated tools ensure that routine problems are addressed instantly, allowing human agents to focus on complex cases.

Outsourced IT help desk teams handle day-to-day issues, freeing internal IT staff to focus on strategic initiatives like software upgrades, network optimization, and cybersecurity.

However, most employees are quite frustrated with IT responses and prefer to solve their problems themselves. This means that IT services need quite a lot of improvement. This is one of the reasons why, in 2026, Managed IT services or IT service management (ITSM) is focusing on resolving issues faster and improving the overall user experience.

In this environment, companies are outsourcing their service desks to cut costs and deliver better support than they could in-house. Nearly 80% of organizations say their service is now better than when handled internally.

This improves overall IT help desk benefits, driving higher productivity across the organization.

Traditional Service Level Agreements (SLAs) focus on speed and resolution, but Experience Level Agreements (XLAs) prioritize user satisfaction.

Zendesk reports that 87% of IT leaders say experience-level agreements (XLAs) help them pinpoint areas where support can improve, with employee satisfaction being the top measure of service quality.

This is why outsourced IT helpdesk providers are increasingly adopting XLAs to ensure that employees feel supported, improving morale and efficiency.

Swarming support is a collaborative problem-solving approach where multiple experts tackle complex tickets simultaneously.

The traditional three-tier service desk, made up of generalists, technicians, and subject matter experts (SMEs), can slow things down for complex issues. Each handoff adds delays, increases costs, and reduces productivity. In fact, as tickets move up the levels, employee downtime can jump from 2 hours to an average of 9 hours and 28 minutes according to HappySignals.

Fast and efficient ticket handling is essential to keep employees happy and productive. That is why many help desk providers are turning to swarming for urgent or complex problems.

Swarming is a modern IT support approach where experts from different teams collaborate right from the start to solve issues quickly. It works especially well for time-sensitive or cross-functional problems, avoiding the delays and frustration that come with the traditional tiered model.

This method reduces resolution time and ensures higher success rates, giving businesses a competitive edge in fast-paced markets.

Several industries are adopting outsourced IT services to address unique challenges in 2026. Here’s a look:

The healthcare sector relies heavily on digital systems, from patient records to telemedicine platforms. Healthcare IT support ensures that hospitals and clinics maintain uptime, secure patient data, and provide uninterrupted care.

Outsourcing IT help desk services allows healthcare providers to focus on patient outcomes rather than tech issues.

Financial technology companies operate in highly regulated environments. Banking IT infrastructure and support for fintech platforms require precision, speed, and security.

Partnering with a fintech software development company offering IT help desk services ensures seamless transactions, cybersecurity, and minimal downtime.

Logistics operations depend on real-time tracking and system reliability. Logistics IT support ensures that shipments, inventory, and fleet management systems run smoothly, reducing operational bottlenecks and improving customer satisfaction.

Retailers are moving towards omnichannel experiences, which require constant IT support. Retail IT solutions and retail IT support help maintain e-commerce platforms, point-of-sale systems, and inventory management tools, ensuring a seamless shopping experience for customers.

Hotels and travel services are increasingly digital, using booking platforms, property management systems, and guest apps. Hospitality IT support ensures these systems function without interruption, enhancing guest satisfaction and operational efficiency.

As businesses evolve, partnering with the right IT helpdesk provider can make all the difference. Here, at Arpatech, we offer customized IT help desk services for each business we work with, designed specifically to meet the demands of 2026.

Two of the most important reasons why partnering with us can benefit your business for the better are:

Arpatech provides bespoke IT helpdesk solutions for businesses of all sizes. From SMEs to large enterprises, our team adapts support strategies to align with your goals, ensuring faster resolutions and improved efficiency.

With remote work becoming standard, Arpatech’s IT help desk for professional tech support ensures round-the-clock assistance, robust cybersecurity measures, and compliance with global standards. Businesses can rely on secure, efficient, and scalable IT support.

In 2026, the role of the IT help desk will be more critical than ever. Whether through outsourced IT services or in-house teams, companies that invest in reliable IT support will enjoy higher productivity, better user experience, and a competitive advantage in their industries.

By embracing automation, AI, and modern IT help desk software, businesses can resolve issues faster, reduce costs, and focus on innovation. Partnering with the IT Help Desk Support Services at Arpatech, you can ensure that your IT infrastructure remains robust, secure, and future-ready.

An IT help desk is no longer just a support function; it is a strategic tool for growth, efficiency, and operational resilience.

Choosing the right IT helpdesk service comes down to your company’s specific needs. At Arpatech, we recommend looking for a provider that offers:

A good IT help desk should not only fix problems fast but also help your team stay productive and satisfied.

While the terms are often used interchangeably, there is a difference:

Help Desk: Focuses on resolving technical issues like password resets, software problems, and hardware troubleshooting. It’s mostly reactive.

Service Desk: Offers a broader approach, including IT service management (ITSM), process improvements, and proactive support. It can handle incidents, service requests, change management, and reporting.

Many companies make these mistakes when setting up an IT helpdesk:

Arpatech helps companies avoid these pitfalls by providing easy-to-use platforms, optimized workflows, and actionable reporting from day one.

Internal Help Desk: Handles IT issues within your organization, supporting employees with devices, software, and network problems.

Technical Support: Can refer to broader support, including external customers, product troubleshooting, or specialized tech services.

Ramsha Khan

Feb 12, 2026

The 21 Best Telemedicine Software Providers for 2026: A...

Telemedicine has transformed the way healthcare is delivered around the world. Instead of driving to an office and sitting in a waiting room, patients now sit in the comfort of their homes and connect with healthcare providers online. From small clinics to large hospital networks, telemedicine software providers help healthcare teams reach more patients, increase practice efficiency, and improve health outcomes.

In fact, recent data shows that telemedicine usage rose significantly during the pandemic, with around 37 percent of adults reporting they used telehealth services in 2021, compared with just 11 percent in 2019. This dramatic rise shows how fast telemedicine has become part of routine care.

This guide breaks down everything you need to know about telemedicine software in 2026: what it is, how it works, the core benefits, important features, how to implement it, challenges providers face, and the top 21 telemedicine platforms worth considering.

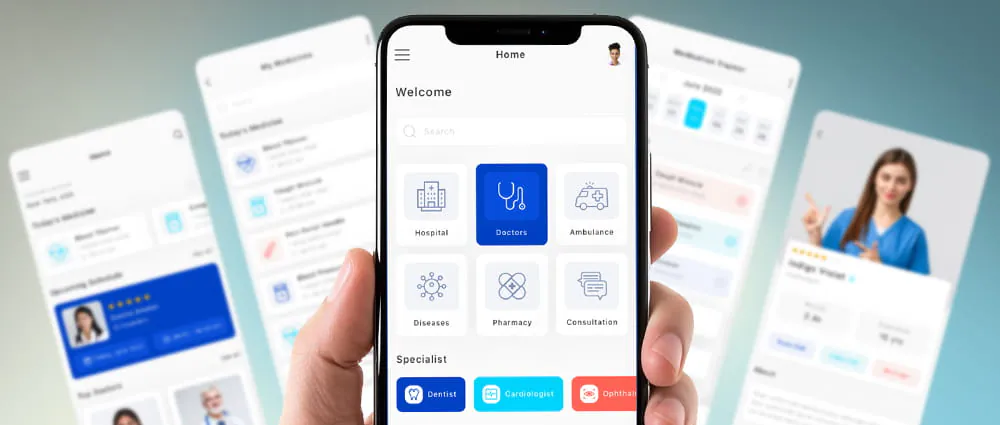

Telemedicine software is a special digital system that allows for the provision of medical care from a distance between patients and healthcare professionals. It combines all the tools necessary for secure communication, such as video appointments, electronic health records, messaging, scheduling, and billing, into a single solution.

Telemedicine software uses common technologies like:

These technologies work together to create a digital environment where care delivery is easier, faster, and more connected.

Telemedicine expands access to healthcare. Patients living in remote areas, those with mobility challenges, and busy individuals now have more ways to access care without travel. Virtual care can lead to better patient compliance and more frequent follow-ups.

Telehealth providers are also not left behind. When health operations go digital, we already know that patients benefit, but there are huge gains for the providers and hospital staff as well. These advantages include:

These benefits help both clinicians and patients have smoother, more satisfying experiences.

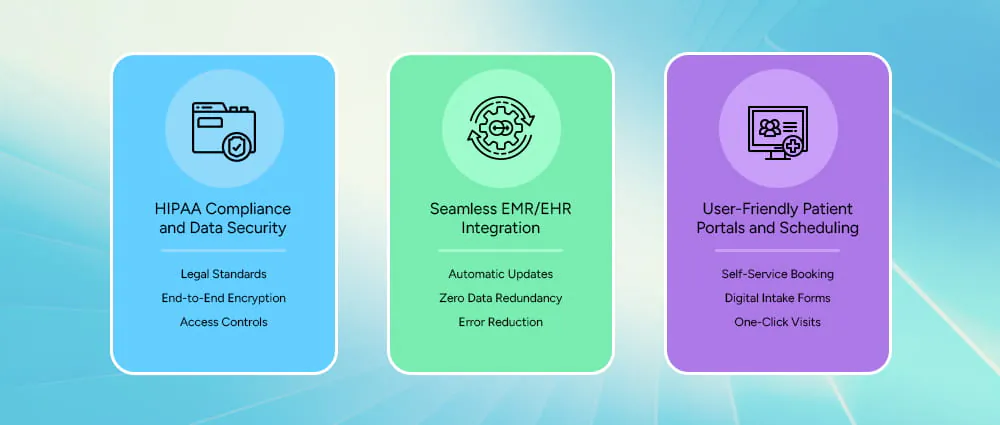

When you’re developing a Telemedicine app, there are a few mandatory healthcare-related requirements that must be included in the software, and we can’t skip them at any cost.

Telemedicine platforms must protect health data according to legal standards, including encryption and secure access controls. Providers must choose systems that meet privacy regulations to ensure patient trust.

Integrating telemedicine with EHR systems means that patient records update automatically. Providers don’t need to enter data twice, which reduces errors and improves efficiency.

Good telemedicine platforms let patients self-book appointments, complete intake forms online, pay bills, and join visits without technical headaches. This improves adoption and satisfaction.

Below are the Top 21 telemedicine software providers for 2026. Each review includes what makes the platform unique and how it helps healthcare providers.

Best for Large-Scale Enterprise Integration

Mend is a comprehensive telehealth solution designed for complex enterprises and large practices. It automates administrative tasks such as appointment reminders and patient registration.

This app uses predictive analytics to reduce no-shows and improve patient engagement with automated workflows. Providers can also customize the platform with branding and secure messaging to keep patients informed.

Best for Simple No-Download Access

Doxy.me is among the leading solutions for clinics looking for a simple yet effective telemedicine solution. Patients connect to the appointments via a browser link, thus no app installation is required.

The service offers video calls compliant with HIPAA, virtual waiting rooms, and basic integration with Electronic Health Records as features. Its user-friendliness is a perfect match for single doctors and small clinics.

The Industry Leader in Virtual Care

Teladoc Health belongs to the biggest telehealth software companies worldwide. It provides round-the-clock access to doctors for the different specialties like general medicine, mental health, dermatology, and chronic condition management.

The system has capabilities for advanced analytics, AI-driven risk assessment, and monitoring of patient outcomes. Its worldwide presence and ability to scale up make it suitable for very large hospital chains and telehealth operations at the enterprise level.

Best for Integrated EHR and Billing

athenaOne combines practice management, billing, EHR, and telemedicine into one unified system. Providers already using athenaOne benefit from seamless workflows without needing separate software. It supports scheduling, virtual visits, and billing within one shared environment, which reduces administrative burden and data duplication.

Used for Private Practitioners

SimplePractice is widely used by therapists, counselors, and solo healthcare providers. It combines telemedicine with practice management features like clinical notes, scheduling, billing, and insurance claims. Its focus on user experience and integrated tools helps small practices save time and manage all patient needs in one place.

Best for Patient Communication and Messaging

Klara is the one who offers the best communication tools for patients. Besides providing video calls, the company has secured its communication with messaging, reminders and patient engagement. The features of Klara lead to conversations among the three parties: doctors, staff and patients. The unified inbox of Klara diminishes phone calls and at the same time, increases the speed of replies.

The Software for Flexible Workflow Customization

eVisit is a provider of software for telemedicine that allows its users to customize the workflows to their liking. Among the extra features are virtual waiting rooms, advanced scheduling and support for complex cases in academic or multi-specialty practices. eVisit is flexible enough to keep up with the changes in the practice and even the growth.

Best for Remote Patient Monitoring

AMC Health is the company that specializes in remote patient monitoring (RPM) plus telehealth visits. They put patients’ wearable devices connected to provider’s dashboards that help doctors to monitor vital signs and even see the trends over time. This attribute is very effective in taking care of chronic patients like diabetics and those with heart diseases.

Best for Low-Bandwidth and Rural Areas

swyMed delivers reliable telemedicine performance even with limited internet speeds. It works in low-bandwidth environments, making it valuable for rural clinics and global health providers. It supports secure video, messaging, and device integrations.

Go for This if You Have Multi-Specialty Clinics

VCDoctor is a versatile telehealth system accommodating various specialties under a single umbrella. It encompasses online appointment setting, secure video conferencing, virtual waiting areas, and payment processing for patients. Clinics that offer varied services gain the most from their flexibility.

Ideal for Behavioral Health Experts

SecureVideo is the product of security and ease of use ceiling. It offers HIPAA-licensed video visits, secure messaging, and appointment tools. Psychologists and counselors, who work in the field of behavioral health, value its user-friendliness and privacy features.

The Most Secure Document Sharing and Faxing App

Updox is a powerful all-in-one communication platform built to simplify how healthcare teams talk to patients and share medical information. It supports secure telemedicine visits, encrypted messaging, eFax, and document sharing, all from one dashboard. This means doctors and staff no longer need to switch between multiple tools to send lab reports, prescriptions, or patient forms.

What makes Updox especially valuable is its ability to connect with over 100 EHR systems. This allows clinics to send and receive medical records directly from their existing software without printing, scanning, or manually uploading files. For busy practices, this saves time and reduces errors. Patients also benefit because they receive their test results and documents quickly and securely, which improves communication and trust.

Best for Collaborative Care

NextGen Virtual Visits is designed for healthcare teams that work together to treat patients. It allows doctors, nurses, specialists, and care coordinators to join virtual visits or share patient information in real time. This team-based approach helps ensure that everyone involved in a patient’s care stays on the same page.

The platform integrates virtual visits directly into clinical workflows, so providers can review patient records, write notes, and create treatment plans without leaving the system. Shared documentation makes it easier to coordinate care, especially for patients with complex or long-term conditions.

Best for Mental Health Practice Management

TheraNest is built specifically for therapists, counselors, and mental health clinics. It combines secure telemedicine with tools for scheduling, note-taking, billing, and client management. This allows mental health professionals to focus more on their clients instead of paperwork.

The platform also supports group therapy sessions, progress tracking, and outcome reporting. These features help therapists understand how their patients are improving over time and adjust treatment plans when needed.

Never Misplace Your Clinical Documentation

TherapyNotes is a favorite among counselors and mental health providers who want to keep their records organized and easy to access. It simplifies clinical documentation by offering structured templates for session notes, treatment plans, and progress reports.

It also includes secure telemedicine, online scheduling, and integrated billing, which means therapists can manage their entire practice from one system. With everything stored safely in one place, providers can spend less time on administration and more time caring for their patients.

Best for Behavioral Health EHR

Valant EHR Suite caters to behavioral health practices of all sizes. It includes powerful clinical documentation, scheduling, billing, and telemedicine features designed for psychiatric and therapy practices. Its data-rich dashboards help clinicians monitor outcomes and practice trends.

Best for High-Security Video Consultations

Healthie focuses specifically on secure, encrypted video sessions. Providers who want top-tier privacy for sensitive consultations, such as psychiatry or addiction medicine, find this platform especially useful. It supports virtual waiting rooms and secure file sharing.

The App for Specialized Medical Groups

Secure Telehealth delivers telemedicine tools tailored to specialized clinical groups. It offers customizable security settings, virtual visit templates, and clinical workflow support. Specialists who require specific documentation and visit types benefit from its custom features.

Best for Scaling HIPAA-compliant virtual care solutions

VSeeHealth is an adaptable telehealth and digital health platform that accelerates the development and expansion of virtual care systems in healthcare organizations. The platform provides secure HD video visits, remote monitoring, scheduling, and billing, among other things, thus being appropriate for hospitals, health systems, and specialty practices. The company has over 1,000 clients globally and processes more than 1.5 million HIPAA-compliant video encounters monthly, indicating its capacity to provide services at scale across urgent care, primary care, mental health, and intensive care.

Bring Discipline with This Healthcare Workforce Scheduling App

Deputy is focused on scheduling and workforce management for healthcare teams. While not a traditional telemedicine tool, it supports virtual care planning by ensuring providers are scheduled efficiently for online and in-person shifts.

Best for High-Definition Video Quality

BlueJeans Telehealth by Verizonprovides high-definition video conferencing optimized for medical consultations. It includes secure messaging, appointment reminders, and integration with scheduling systems. Its video quality makes it excellent for clinical assessments that require clear visual communication.

Providers use telemedicine for general appointments such as colds, follow-ups, wound checks, and medication reviews. Many chronic illness check-ins, like blood pressure and diabetes, can be done safely without in-person visits.

Telemedicine is also used for ongoing care of conditions like asthma, cardiac care, and postoperative monitoring. Remote monitoring tools share patient data with providers, allowing early intervention and better outcomes.

A Step-by-Step Guide to Telemedicine Software Solutions. This is what you’re going to need when you implement telehealth software features in your business.

In case your practice calls for one-of-a-kind workflows, superior integrations, or personalized branding, it would be wise to partner with a reputable telemedicine software development firm such as Arpatech.

Arpatech and similar companies develop telemedicine software solutions that are completely customized according to the client’s clinical and operational requirements, hence assuring seamless integration with EHR systems, patient portals, billing tools, as well as remote monitoring technologies.

This method provides health care professionals with more freedom, a better-growing along with a platform which suits their practical work processes rather than putting them into strict, off-the-shelf systems.

Providers must understand rules related to licensing, telehealth reimbursement, and data privacy in their region. Regulations vary between states and countries, making compliance complex.

Technical issues like poor internet connections, lack of patient technology skills, and device limitations can hinder telemedicine use. Providers must offer guidance and alternatives to improve access.

Selecting the right telemedicine software for providers depends on your goals, your patients, and how your practice works. Whether you need a basic video platform, a full EHR system, or a custom telemedicine solution, the platforms listed above are among the best options for 2026.

If you need something more personalized, Arpatech provides telemedicine software development services, including custom platform building, system integration, and ongoing technical support to help healthcare providers run virtual care smoothly.

Telehealth uses specialized systems like video conferencing, patient portals, EHR integrations, secure messaging, and remote monitoring tools designed specifically for healthcare.

Telemedicine software improves access, reduces wait times, enhances patient experience, and increases provider efficiency.

Telemedicine can provide urgent care, chronic disease management, therapy, follow-ups, behavioral health, and preventive medicine.

Patients need a device with a camera, internet access, and instructions on how to use the telemedicine platform.

By reducing administrative work, lowering no-show rates, and offering flexible scheduling, telemedicine helps practices serve more patients with less strain.

No. Providers must use secure, HIPAA-compliant telemedicine platforms designed for medical use to protect patient privacy and follow regulations.

Ramsha Khan

Jan 22, 2026

Telemedicine Startup Costs (2026): Factors Affecting th...

Telemedicine has become a critical part of modern healthcare, enabling patients to receive care remotely while giving healthcare providers tools to expand their reach efficiently. Whether it’s virtual consultations, remote patient monitoring, or teletherapy sessions, telehealth is reshaping how care is delivered.

For entrepreneurs entering this field, the first question is often: What is the telemedicine startup cost in 2026?

Costs vary depending on technology, regulatory compliance, staffing, equipment, and marketing. Today, we will break down the factors affecting telemedicine startup costs, explain different platform options, and provide a roadmap for building a successful telehealth business.

Even though we can say that a telemedicine startup cost can range from $8,000 to $150,000+, but if you’re looking for the breakdown, read ahead for that and learn what factors affect the costs. Telemedicine startup costs are not fixed. Several key factors determine how much your platform will cost:

The type of service that you provide will significantly affect costs. In the case of mental health therapy platforms, they will need to set up secure video consultations and also enact strict patient privacy measures, whereas, for chronic disease management, there will be a need for medical device integration and a more sophisticated analytics dashboard. The service’s degree of complexity will lead to increased telemedicine startup costs.

The budget is determined by the extent of your startup’s market. Providing services to a local clinic is much cheaper than targeting the whole country. A wider market is going to need more infrastructure, looser compliance, and most probably, a higher staff count.

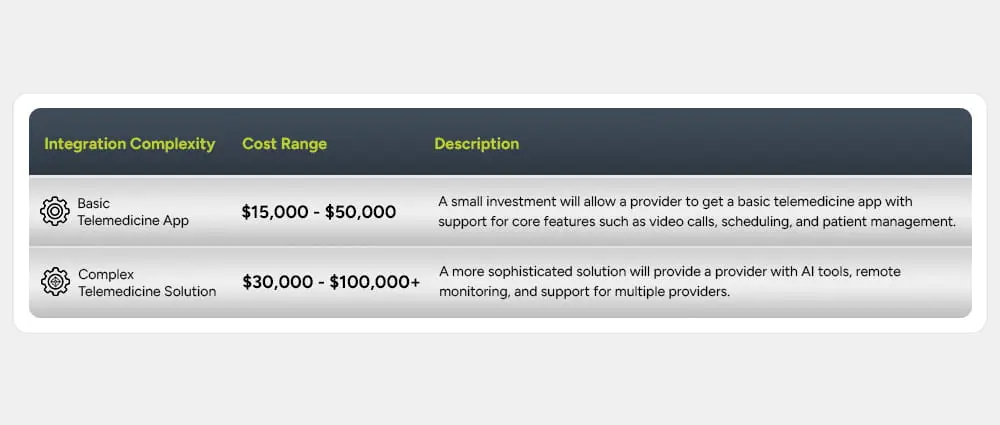

Basic video consultation features, along with the patient chat option, are easy to build and cost around $15,000 – $50,000. On the other hand, next-generation solutions incorporating AI, remote patient monitoring, or multi-provider support can run up to $30,000 to $100,000+ or even more.

Healthcare is heavily regulated. In the US, HIPAA compliance and licensing are mandatory. Startups typically spend $5,000 – $15,000 on licensing and compliance. Skipping this step is risky and can lead to fines or legal issues.

Telemedicine platforms are not merely costly; they, along with the healthcare workers, save money too.

A smaller number of rooms is needed for the clinic, thus less rent and overhead.

Virtual consultations permit the doctors to have more patients at the same time, thereby lessening the monthly staff cost, which is between $3,000 – $25,000+, depending on the size of the team.

The automated processes of scheduling, reminders, and billing lead to a reduction in administrative costs.

Your telemedicine platform becomes more appealing to providers due to the cost savings it demonstrates, which leads to higher adoption rates and thus the long-term profitability of the providers.

Partnering with the right development team can make or break your startup.

Choose a telemedicine app development company that understands patient workflows and provider requirements.

The company should be familiar with HIPAA, state licensing, and other healthcare regulations.

A good development partner can start with an MVP and support future feature expansions.

Avoid hidden costs. Your partner should provide a clear breakdown of telemedicine app development services and related expenses.

A telemedicine startup is not just a technology project. It is a healthcare business, and healthcare leaves very little room for guesswork. A well-structured telehealth business development plan helps you avoid costly mistakes, control your telemedicine startup cost, and build a platform that can grow sustainably over time.

Think of this plan as your blueprint. It guides every major decision, from what features you build first to how much money you need to raise and how quickly you can scale.

The telehealth concept gets the examination of the market demand in the first place, and that is where the market analysis comes in. In order to develop the product, one must first have a clear picture of the user group and the specific issues that they want to solve.

The process includes understanding the patients’ behaviors, pinpointing the existing telehealth platforms’ weaknesses, and getting a grasp of the competitors’ strategies. This procedure is particularly crucial for new businesses planning to enter the US market, as patient expectations are high, and there are strict regulations over the quality of care.

During the market analysis the following aspects should be considered:

Well-executed market analysis means that your startup costs for telemedicine company in the U.S. or globally will be spent on the right solution, one that people indeed want and need.

A service model of your business will tell about the telemedicine startup in a way that it will make money. In fact, this decision will have a direct impact on both your revenue and long-term scalability.

The core question is whether the platform you would offer would serve patients, healthcare providers, or both. Each model has different operational and technical requirements.

The typical telemedicine service models are:

Choosing the right service model early on helps create features that align with revenue goals and also saves the cost of making changes later in the development process, which can be costly.

The technological roadmap of your platform indicates its evolution in the future. This particular method not only gives quicker launches but also better and more economical spending since everything will not be built at once.

At first, you should decide on your Minimum Viable Product, or MVP. Only the most critical features that can provide value are included here, such as video consultations, user onboarding, and appointment scheduling, etc. You will, later on, be able to add more advanced features gradually, depending on the user feedback, after the MVP is up and running.

A technology roadmap that is clear and precise usually contains the following:

The above-mentioned staggered method will help reduce costs related to the telemedicine app development, but at the same time, it will guarantee that the platform is flexible and ready for the future.

Financial projections summarize all aspects of the business scenario. It is in this section that you perform the calculation for the realistic cost of your telemedicine startup and the time needed to achieve the break-even point.

The projections must reflect not only the initial expenses but also the recurrent ones. Development, compliance, staffing, infrastructure, marketing, and equipment, among others, are included in this. The majority of startups fail to accurately calculate these costs, and if the budget is not controlled well, it can lead to significant financial problems.

Your financial road map should cover the areas of:

By indicating these costs explicitly, you will have an accurate estimation of the total cost of starting a telemedicine business and will be able to set funding or revenue milestones accordingly.

The business development plan for a telehealth company that is well structured and one that can adapt to any market, whether US or global, ensures that the budget for the telemedicine company is not based on pure guesses but on a well-thought-out strategy, market research, and the setting of clear priorities.

It not only enables you to maintain your attention, but also facilitates decision-making based on facts, and the development of a telemedicine platform that meets the requirements of being financially secure, ready for expansion, and compatible with the actual needs of the healthcare sector.

Telemedicine offers more than just software. One of the main factors involving telemedicine apps is the equipment:

Among hardware necessities are video conferencing devices, diagnostic tools, and networking equipment.

On the other hand are digital stethoscopes for tele-health, patient monitoring gadgets, and AI-assisted diagnostic tools.

The range of equipment costs is from $10,000 to more than $110,000 based on the complexity and scale of the establishment.

Opting for the right equipment provides the guarantee of patient safety and the effectiveness of service delivery at the least possible cost.

Establishing a telemedicine startup demands an organized plan. Every stage is highly important in managing the cost of your telemedicine startup and at the same time, setting up for future success.

The first thing that you need to do is to decide what kind of telemedicine service you are going to provide to your audience. Will the application focus on psychotherapy, general practitioners, ongoing illness treatment, or expert advice?

Narrowing down your niche will simplify your tasks like developing the product, coming up with a marketing plan, and even taking care of legal matters. A specific niche can cut down on costs that would otherwise be spent on uncovered features and services. The audience to whom these are directed is the one who needs them.

Before going the heavy investment route, check if there is demand for the niche you have selected. You may conduct surveys, interview potential users, and do competitor analysis.

Grasping the market is a way of ensuring that your medical costs for the US or global market are not wasted, thus the risk of developing a non-used platform is minimized.

The selection of your technology will impact your development costs alot. Therefore, it is essential to make a decision whether you need a mobile application, a web application, or both at this stage. Besides, you will have to go for the frameworks, databases, and cloud infrastructure that guarantee security and scalability.

Early selection of the right tech stack may help in eliminating rework with an accompanying cost and also ensuring your platform being able to cope with the entire growth.

A reliable partner for development will provide you with the expertise of medical workflows, safety measures, and complying with regulations. A telemedicine application development business can help you efficiently establish your platform while still assuring that it meets the legal standards.

Healthcare interoperability is a highly regulated industry. Securing licenses and complying with HIPAA or local regulations is mandatory. If you fail to meet these requirements, it can lead to legal penalties and project delays.

Usually, licensing and compliance can cost $5,000 – $15,000, but this investment safeguards your startup in the long term.

Instead of creating a comprehensive platform with all the functionalities at once, start with a Minimum Viable Product (MVP), which includes the most important features like video consultations, patient registration, and scheduling.

The starting startup costs for telemedicine company US MVPs can go as low as $15,000 to $50,000 and at the same time, you can also test the market and collect user feedback without making a large expenditure.

Following the launch of your MVP, assess user activity and opinions to determine the order of improvements. Step by step, introduce sophisticated features like AI analytics, remote monitoring, or multi-provider support.

The process of scaling gradually makes sure that every investment is backed and it is less likely that you will build features that are expensive and not needed by the users. The cost of complex telemedicine solutions usually starts from $30,000 – $100,000+ as you scale up.

Each of these steps helps control your telemedicine startup cost by reducing uncertainty, avoiding rework, and ensuring your platform meets both market needs and compliance requirements. Following this roadmap sets the stage for a sustainable and successful telehealth business.

The true cost goes beyond development. Consider:

Accounting for these ensures you are not surprised by hidden expenses.

It is anticipated that overall spending on development projects will go up just a little in 2026 because the demand for sophisticated features will be on the rise as one of the main factors influencing this decision.

Most of the time, startups will start off with a white-label solution to validate their market, and then scale up their operations by switching to custom development later on.

To start smart:

This approach keeps your startup costs for telemedicine company US under control while building a sustainable business.

Launching a telemedicine startup in 2026 requires careful planning and budgeting. Understanding telemedicine startup costs, from development and staffing to equipment and compliance, helps you avoid surprises and maximize ROI.

At Arpatech, we specialize in creating custom telemedicine platforms that are secure, scalable, and fully compliant. Whether you need a basic MVP to test your market or an enterprise-level solution with advanced features, Arpatech’s telemedicine app development services can help you turn your vision into reality efficiently and cost-effectively.

When it comes to telemedicine startup in the US, it is mandatory to follow with HIPAA, state licensing, and patient data protection laws.

The price ranges from $8,000 through $150,000 or more, depending on the features, compliance, and staffing. Outsource the development or hire a telemedicine app development company, you will get about the same pricing.

Telemedicine is profitable through subscription fees, per-consultation charges, and B2B collaborations. Besides, reduction in operational costs for doctors makes it easier for them to switch over to telemedicine.

The charges depend on platform complexity, session volume, and staffing. Teletherapy necessitates a secure video infrastructure and compliance measures.

Telemedicine is not just an issue of accessibility, convenience, and cost but a very strong rotating business opportunity with a growing demand factor.

Ramsha Khan

Jan 8, 2026

Telemedicine App Development from Scratch – Guide...

Telemedicine has come a long way, and it is no longer just a convenient video call to the rehabilitation doctor. By 2026, it had developed to become a major staple of contemporary health care. Fast consulting, remote monitoring, digital prescriptions, and seamless communication with medical professionals are some of the things that patients are now expecting and that is why more and more hospitals, clinics, and health care startups are pouring their resources into telemedicine apps. Patients no longer have to visit the provider in person; they just go where there is digital access.

The need for trustworthy and safe telehealth platforms has led to organizations hunting for the best telemedicine app development company. But here is the bright side. The creation of a telemedicine application from scratch is fully doable, even if you’re not a techie. What you need is only a well-defined strategy, appropriate tools, and a clear roadmap.

Today, here we will guide you through the entire process, starting from the understanding of the telemedicine market in 2026 to the telemedicine app development, what features it should have, and the trends your app should be following.

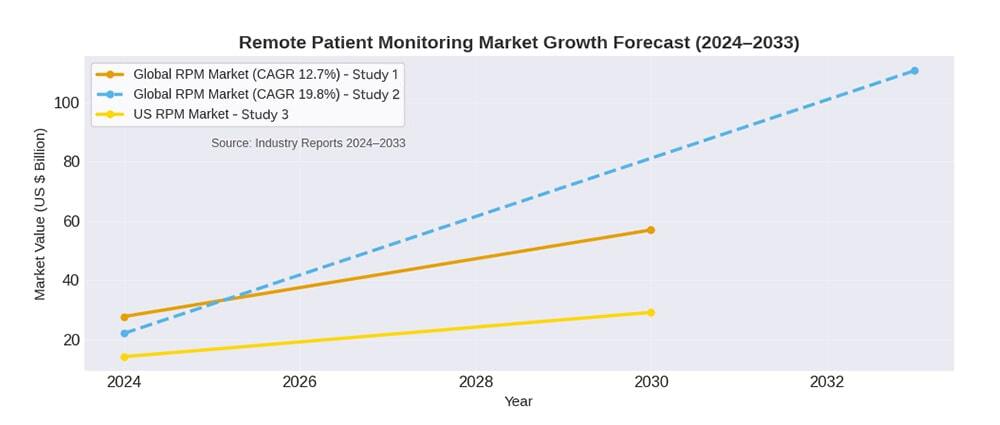

Telemedicine is no longer a niche convenience service. It is rapidly becoming a foundational component of global healthcare. As we look toward 2026, the scale, reach, and expectations for digital health platforms have grown dramatically. The market data from 2023–2025 point to a strong and accelerating adoption across regions, settings, and specialties.

In short, this data above clearly shows an expanding and accelerating market.

Because of this growth, more institutions are investing in, custom telemedicine app development solutions to future-proof their services and offer digital health at scale.

Multiple factors contribute to the boom in telemedicine. The data and broader industry shifts help explain why demand for telemedicine apps and services is skyrocketing:

The boom in telemedicine can be attributed to multiple factors. The data and wider industry transitions are helpful in explaining the increase in the demand for telemedicine applications and services in the following ways:

The global elderly population, rise in chronic diseases, and absence of adequate medical professionals in remote or sparsely populated areas have all contributed to the need for healthcare systems to be remote and accessible.

Patients like to have the option to choose: they can have remote consultations, less travel or waiting time, and better follow-ups. This has facilitated the transition of many providers to the digital-first model. Telehealth contributes to a reduction in hospital readmissions and emergency visits, hence creating a win-win situation for both patients and providers.

Better internet access, widespread smartphone usage, wearables, and infrastructure improvements are making remote monitoring, data sharing, and digital consultations more dependable. The above-mentioned improvements have empowered the healthcare organizations to take the risk of investing in telemedicine mobile app development solutions.

There is a greater focus on preventive care and remote monitoring (especially for chronic disease patients). Now, patients don’t have to go to the hospital for every check-up; they can just have a telemedicine consultation and get care at home. This shift pushes the use of remote patient monitoring together with virtual consultations.

More and more hospitals and healthcare providers are now seeing telehealth not as a temporary solution but as a permanent strategic option. They are making investments in establishing or joining forces with others to create comprehensive telemedicine ecosystems.

With the success of telemedicine, the governments and regulatory bodies in different parts of the world have started to set up the necessary conditions for digital health services. This not only increases trust and compliance but also diminishes the obstacles for healthcare organizations to put in place remote care solutions and thus, the demand for full-fledged edge computing telemedicine app development services is rising sharply.

Healthcare organizations are increasingly inclined toward custom telemedicine app development, which is secure, scalable, integrated and tailored to meet their specific needs rather than towards one-size-fits-all generic solutions.

From the perspective of market dynamics, generic or off-the-shelf telehealth platforms usually do not meet the needs of the organizations. This is the reason why custom-built solutions are widely chosen:

All these factors put together provide an explanation for the strong demand for and the high supply of telemedicine app development services, and for the trend of many healthcare providers to collaborate with experienced development firms instead of sticking to generic products.

The telemedicine industry in 2026 is shaped by both technology and patient expectations. Here are the top trends influencing the future of telehealth platforms.

AI has reached the point where it is the main character in all the healthcare digital transformation stories, from smart symptom checking to clinical decision support, appointment routing, and predictive analysis. To put it simply, AI triage apps have turned doctors into less busy but more efficient healthcare providers as they get patient answers in no time.

Telemedicine applications work hand in hand with smartwatches, glucose monitors, ECG devices, and fitness bands that cut each other’s waiting time. As a result, monitoring of chronic diseases such as diabetes and hypertension can be done remotely.

Certain medical areas are utilizing VR in rehabilitation, mental health, and physical therapy. VR provides engrossing treatment sessions, making therapy more effective and at the same time more reachable.

Patients count on the applications to keep track of their medical history, habits, medication timings as well as preferences. Bespoke dashboards not only enhance but also engage and keep the patients.

The benefits of telemedicine apps include automatic system prescription updates, reminders, and pharmacy delivery services.

Rather than developing separate video call applications, healthcare companies nowadays prefer investing in entire systems. Such systems comprise patient portals, doctor dashboards, admin control panels, and integrated billing.

These trends indicate why organizations lean towards custom telemedicine app development rather than opting for off-the-shelf software. A custom approach gives total control over the features, the user experience, and the compliance.

Telemedicine is not just for general checkups. It has expanded into nearly every area of healthcare with practical, high-impact use cases.

Patients have the opportunity to consult with doctors at any time, without the need to travel or deal with congestion in hospitals.

Mobile applications follow up and monitor chronic diseases like diabetes, asthma, and heart disease. Physicians keep an eye on the patients’ health data and make changes to treatment plans from afar.

Internet-based counseling, therapy, and psychology consultations are not only frequently used but also very effective.

Prescription medicines are stored electronically, renewal process is simple, and delivery to pharmacies is done automatically.

Patients in underserved regions get access to specialists that are not available locally.

Patients are able to send recovery photos, vital signs, and symptoms to the medical staff via the application instead of going for several hospital visits.

Telehealth with the support of AI is helpful in the evaluation of emergency cases and the redirection of patients to instant care.

Telehealth services provide safe and easy-to-do consultations for young children and seniors who cannot leave their homes due to health issues.

Healthcare providers that implement such models usually search for a telemedicine application development that offers a good user experience along with strong compliance and efficient real-time data management.

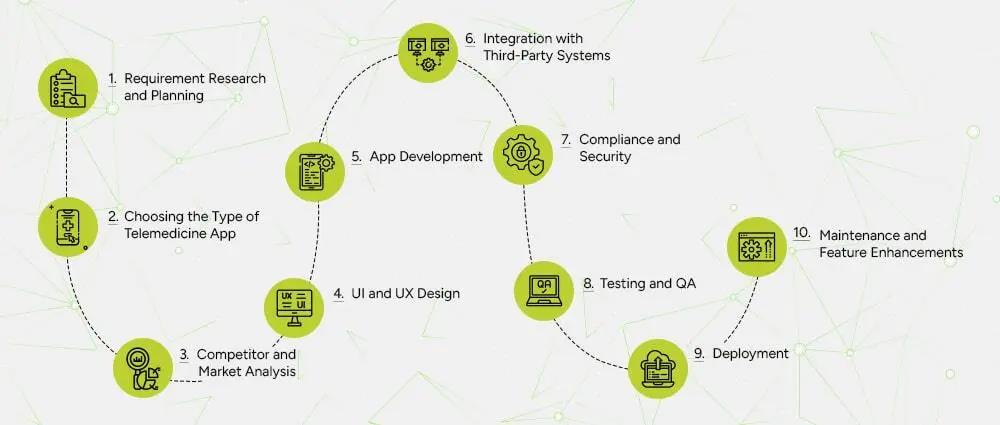

If you are planning to build a telemedicine app from scratch, following a clear step-by-step approach makes the entire journey easier.

Telemedicine users want clarity. Good design keeps them engaged and confident.

The real coding action starts here. Developers create:

This phase often needs a skilled telemedicine application development company.

Compliance is critical in telemedicine. Developers ensure:

Security is a non-negotiable part of every custom telemedicine app development solution.

Test for:

Launch your app to the Apple App Store, Google Play Store, or your organization’s private environment, depending on your target audience.

Maintenance and on-going support includes:

A long-term partnership with a reliable telemedicine app development service ensures your app continues to grow with your business.

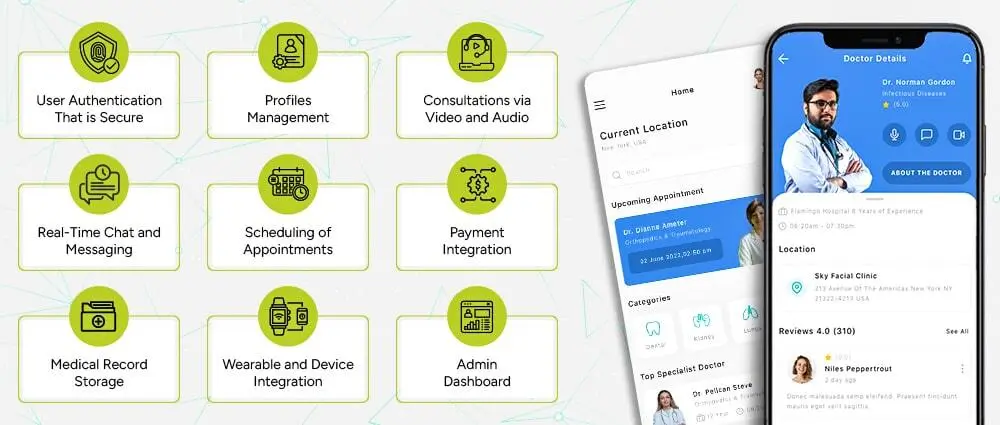

To succeed in 2026, every telemedicine app must include a strong set of essential features that support smooth communication, secure data handling and reliable patient care.

Provide login through email, phone number, and two-factor confirmation, so that only the authorized people to access medical information can be there.

Make it possible for patients, doctors, and admins to create comprehensive profiles that keep the major facts and make the diagnosis more precise.

Offer very good and clear communication in terms of video and voice because virtual appointments are very much dependent on stable and clear connections.

Facilitate secure text messaging for the purpose of making patients asking follow-up questions and sharing reports or images, for instance, file sharing.

Allow the users to book, reschedule, or cancel appointments without any problem while doctors are controlling their availability in real-time.

Support smooth and secure online payments for consultations, follow ups and treatment plans.

Store reports, images, previous consultation notes and health history in encrypted formats for easy future access.

Connect with smartwatches, glucometers and other devices to capture live patient data for better diagnosis.

With healthcare IT support, give administrators tools to manage users, doctors, reports, billing, support tickets and system analytics in one place.

Companies that build all these elements into their apps usually offer a wide range of telemedicine app development solutions that meet modern healthcare needs.

The cost of telemedicine app development is based on several factors like features, the type of app, technology used, and the place where it is done. Even though all projects differ, below is a rough estimate.

This is where companies usually invest in custom telemedicine app development for long term scalability.

Cost also depends on whether you choose:

Telemedicine has completely changed the entire healthcare interoperability experience by increasing accessibility, speed, and efficiency of medical support.

As we step into the year 2026, every healthcare provider that wishes to remain competitive must undergo a digital transformation. This is the reason why telemedicine app development process is emerging as a high-growth area in healthcare technology.

Building your telemedicine platform is a way to growth, better patient engagement, and stronger service delivery irrespective of whether you are running a clinic, managing a hospital network, or creating a healthcare startup. Besides, the telemedicine app development company, a good plan, and user experience will help create a trustworthy digital healthcare ecosystem that is audience-tailored.

Each phase from market trend comprehension to needed features selection, following telemedicine app development process, modern technologies addition, security assurance, etc., is a contributor to a successful launch. Custom solutions that allow designing workflows, interfaces, and connections really match your medical operation are particularly diversified.

Digital is the future of healthcare and telemedicine is at the forefront of it. So, work with Arpatech to give your telemedicine shape and create a solution for your patients that helps them to the maximum.

The telemedicine software spectrum is quite vast comprising different types of applications based on the requirement, from very basic video consultation platforms to sophisticated health record and remote monitoring systems. The most common software parts are:

If you choose to work on a custom telemedicine solution, the entire software components are integrated to provide a secure, flexible, and scalable telemedicine experience.

Yes, AI and other associated technologies have become a major factor in the development of modern telemedicine. The use of AI in telemedicine apps is not uncommon. Here are some of the activities that AI performs in this field:

Thus, AI is not simply something you can say is nice-to-have; in fact, it is the core part of the solution in the case of multiple advanced telemedicine app development, where it helps to improve efficiency, accuracy, and patient experience.

Remote consultation, which allows to see, hear, or chat with the doctor, is the most common type of telemedicine, and this type is without a doubt the most preferred among all doctor-patient consultations, which makes it the main scenario in telemedicine.

Nonetheless, there are also other consultations supported by telemedicine like remote monitoring of the patient, managing diseases, e-prescriptions, and mental health consultations, etc.

Though physicians’ consultation via telemedicine is the most common and the simplest form of it, yet telemedicine is wide-ranging and continues to be the impenetrable barrier of accessing healthcare for a lot of providers that have already gone digital.

Choosing the best telemedicine app or development solution depends on your needs and priorities. Here are key factors to guide you:

Selecting a telemedicine app development company’s solution that balances all these factors will make your telemedicine app reliable, user-friendly, and future-proof.

The implementation or utilization of telehealth apps has numerous advantages for physicians and medical practitioners:

This is actually a matter of who your target users are and what are their scenarios. The following is a decision guide that is very simple:

To put it simply: there is no one-size-fits-all solution. You can say that the best platform is determined by your user base, budget, required features and long-term vision.

To build modern telemedicine applications, the following are the technologies that top the list:

These technologies, when combined properly, allow building a robust, secure, and feature-rich telemedicine mobile app development solution.

Ramsha Khan

Dec 25, 2025

Enterprise Software Development for Healthcare: Using A...

Healthcare is moving into a new era where patients expect fast digital services, hospitals need stronger data security, and administrators want systems that actually make their jobs easier. With so much pressure to upgrade, one thing has become clear. Legacy systems can no longer keep up. The future belongs to digital platforms that integrate smoothly, scale easily, and support automation.

This is where Healthcare Software Development Services and enterprise software development services come into play. Application Modernization Services that rebuild old legacy systems into cloud-native solutions are no longer optional. It is essential for better patient outcomes and smoother hospital operations.

Here, we’re going to explain what is changing in the healthcare industry, why modernization is necessary, and how hospitals can transition to secure, cloud-based, AI-enabled systems by 2026 and offer better healthcare for a long time with no data or power outages for a long long time.

So, let’s learn about the challenges that these legacy systems are burdening the healthcare industry with right now, and how bringing in a cloud-based native system can change it all:

Healthcare organizations across the world face several challenges. Many of these problems come from outdated technology, slow systems, and disconnected software platforms.

Many hospitals still use systems built 10 to 20 years ago. These legacy platforms create problems such as:

These issues affect doctors, nurses, administrators, and patients alike, which is why it is necessary to employ legacy application modernization strategies within our systems.

Patient information is often divided across multiple systems. The lab has its own records. The pharmacy uses separate software. Insurance claims run on a third system. This creates delays, errors, and miscommunication.

Healthcare is among the most attacked sectors globally in cybersecurity. Ransomware assaults, data leaks, and downtime of systems are sources of financial and legal risks. Outdated systems are the easiest to attack.

Manual work is a necessary component in tasks like billing, scheduling, insurance checking, following up with patients, and keeping track of inventory. The burden can be lessened through automation, but older systems do not have the capability to work with the new automation tools.

Telehealth, virtual consultations, and cloud-based patient monitoring grew after the pandemic. Many hospitals still lack systems that support remote services effectively.

Healthcare organizations must follow strict standards like HIPAA, GDPR, local authority rules, and insurance reporting requirements. Outdated systems often lack built-in compliance support.

All of these issues point to the same solution. Healthcare institutions need Custom Software Development, cloud solutions, application modernization services, and modern enterprise software platforms that can meet the demands of 2026 and beyond.

Enterprise software development services are designed to help hospitals move from outdated platforms to smart, scalable, and fully integrated systems. With the right Healthcare Software Development Company, healthcare organizations can build custom software development solutions that support their exact workflows.

Hospitals depend on many systems. Cloud application modernization does not mean replacing everything. It means upgrading or rebuilding these systems into a connected cloud ecosystem.

Let’s break down the core healthcare systems that are commonly used in hospitals today, and how they can be modernized.

Hospitals require a complete management solution that handles:

Legacy HMS platforms often lack automation and advanced analytics. Modern application modernization services and enterprise solutions include cloud native architecture, mobile access, and smart dashboards.

A PMS, Patient Management System, also known as Patient Portal, manages individual patient records, history, medications, and reports. Older PMS systems are slow and disconnected. Today’s application modernization services offer:

Hospital ERP systems manage:

Modern ERP solutions improve cost control through:

Insurance processes are often manual. Healthcare Software Development Services can create custom insurance claim apps that enable:

Hospitals are rapidly adopting telemedicine. With custom software application development, hospitals can integrate:

An LIMS systems created using application modernization services help labs automate:

A pharmacy system currently made using application modernization services supports:

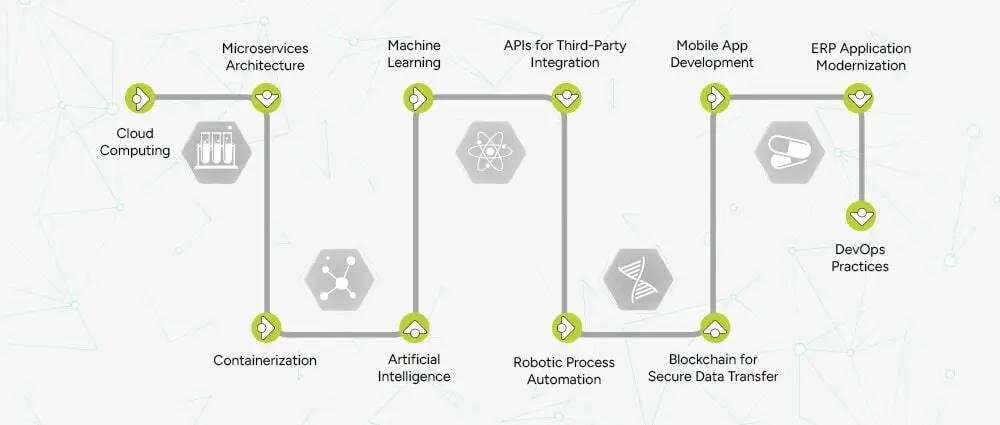

To modernize these systems, healthcare organizations can rely on several technologies offered through Custom Software Development Services. Key technologies include:

Cloud computing is a big step forward for hospitals. They get rid of their old servers and can keep their data securely in the cloud. The systems are therefore faster, easier, and are accessible from anywhere you like.

Microservices help large hospital systems get divided into smaller parts, which can then be updated or fixed without interrupting the entire thing. This way, hospitals can scale faster and ensure better performance.

Containerization packages apps in a way that enables them to run flawlessly on any device or environment. With the help of application modernization services, in return, it allows development teams to quickly release updates with fewer errors.

AI serves as a helpful tool for hospitals by making data analysis, decision-making, and doctor-assistive tools easier and smarter. By providing faster insights, it not only reduces mistakes but also improves medical treatment.

In application modernization services, machine learning gives power to software programs to learn from past data and improve and become smarter over time. Hospitals can use it to predict patient care, identify high-risk groups early, and cut down on the time it takes for diagnosis.

APIs help different healthcare systems talk to each other easily. Through them, hospitals can link laboratories, pharmacy systems, insurance platforms, and patient applications without the necessity of manual work.

RPA is a technology that takes care of the repetitive administrative tasks of the organization, allowing staff to devote more time to patient care. It is particularly suitable for activities like billing, scheduling, claim processing, and data entry. So, add RPA into application modernization services and get rid of manual work for a long time.

The use of blockchain in the healthcare industry is there to ensure that medical data files are shared safely between parties and are not tampered with. This is the foundation that builds trust between hospitals, insurance companies, and patients.

Mobile apps are the main source through which doctors, nurses, and patients can get instant access to important information. Hospitals can provide telemedicine, appointment booking, and easily get patient record access to their clients via cell phones.

Modern ERPs help hospitals manage finance, HR management, procurement, and operations more efficiently, all in one place. ERP application Modernization services and systems of integrated networks offer real-time insights that help reduce costs and improve planning.

DevOps practices are the base that enable development teams to deliver updates faster without system downtime. This makes sure that hospital software stays stable, secure, and up to date at all times.

Each technology helps hospitals reduce costs and increase efficiency.

One of the biggest steps in application modernization services is cloud adoption. By moving systems to the cloud, hospitals gain flexibility, speed, and stronger security.

Healthcare Software Development Services often include the following cloud solutions.

Cloud Migration involves moving existing systems to cloud platforms like AWS, Azure, or Google Cloud. Cloud migration offers:

Instead of simply migrating old systems, hospitals can build entirely new cloud native apps that support:

DevOps in application modernization services helps hospitals release updates faster and maintain systems without downtime. DevOps engineers support:

DevOps combined with cloud technology improves patient services and lowers maintenance costs.

Healthcare data is highly sensitive. Cloud-based systems require strict compliance. A reliable Healthcare Software Development Company offers:

Healthcare systems cannot afford downtime. When offering application modernization services, reliable providers offer:

Ongoing support ensures that healthcare teams remain productive around the clock.

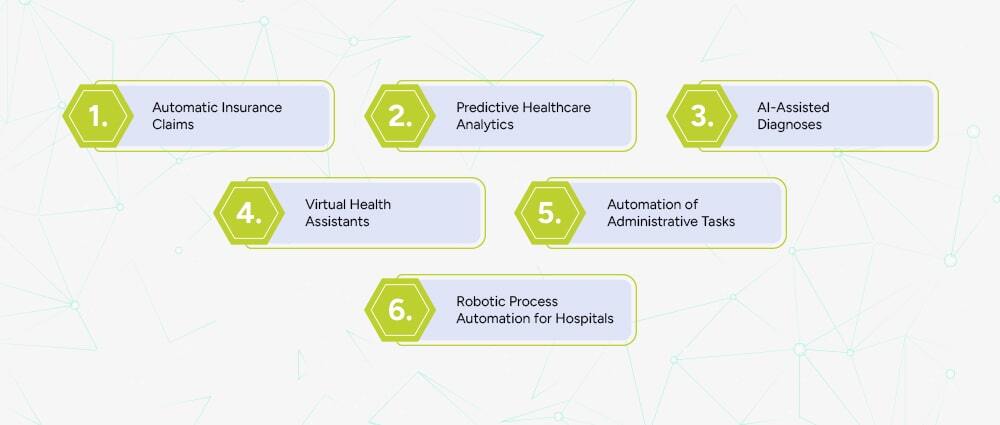

Artificial intelligence and automation are transforming the healthcare industry faster than ever before. By 2026, AI-driven systems will be an essential part of healthcare operations.

Below are some of the latest advancements.

AI can read claim documents, verify details, detect errors, and submit claims automatically. This reduces delays and increases approval rates.

AI in application modernization services can analyze large datasets to predict:

Predictive analytics helps hospitals prepare in advance.

By using AI in application modernization services and following AI software development companies that are building tools that support doctors by analyzing:

These tools help identify diseases early and reduce human error.

Chatbots and virtual assistants can help patients with:

By enabling application modernization services in thier systems, hospitals can automate:

Automation reduces the burden on staff and improves patient satisfaction.

RPA is being used to automate repetitive tasks inside hospital systems, including:

These technologies make healthcare operations faster and more cost-effective.

Choosing the right Healthcare Software Development Company is the most important decision for modernizing systems. Hospitals must assess expertise, security practices, technology stack, and long-term support capabilities.

Here are some factors to consider.

Pick a company that has experience in:

Your partner should be able to upgrade or create:

Advisory services are important because they help hospitals understand:

Hospitals have unique workflows. Your partner must offer:

By choosing Offshore Software Development Services or Nearshore Software Development, hospitals can reduce development costs while working with skilled experts.

Offshore Software Development also provides access to larger talent pools.

When you are outsourcing software development, you must ensure your partner provides:

Your partner must understand:

Arpatech offers healthcare organizations a complete range of Application Modernization Services and enterprise software development services. Hospitals can rely on Arpatech to modernize their legacy systems and build cloud native apps for 2026.

Arpatech supports businesses that want to:

This allows hospitals to reduce costs while receiving high-quality development.

Fast, secure, cloud-based, and AI-enabled systems will be the ones that define the future of the healthcare industry. If hospitals want to compete, they have to give up on old-fashioned platforms and provide first-rate care to patients.

Taking advantage of Healthcare Software Development Services, modern enterprise software development practices, and cloud native infrastructure, healthcare organizations will be able to build an excellent digital foundation for 2026 and the years to come.

website

Modernization of applications is not solely about technology shift. It is a move towards the direction of better treatment to patients, more efficient operations, less expenditure, and sustained victory.

If you require assistance in reshaping your medical systems, then firms such as Arpatech can supply you with the experience, technology, and support that will lead you from the status quo of old systems to the transformation of native cloud application modernization healthcare platforms.

Let’s work on your Healthcare system today!

App modernization is the way of turning an old application into a new one by upgrading it really fast, making it very secure, and adapting it to new technology. The app can choose from a range of options such as moving to a new location, getting extra features, or even a better user interface.

Legacy systems in healthcare signify the long-used technologies that hospitals still depend on even if they do not meet the current requirements. Most of the time, these systems function slowly and do not have the capability to interact with and work along with the new applications.

A large variety of digital tools are available in healthcare, each fulfilling a certain need. The most common types include:

All these tools combined make it possible for hospitals to operate more efficiently and provide better care.

There are several reasons why application modernization is necessary:

Not modernizing might mean that companies lose their competitive edge and suffer from poor customer service.

Application modernization is typically done in a step-by-step manner:

Following these steps will enable companies to upgrade their applications without affecting their everyday operations and will be done in a timely manner.

Cloud application modernization means moving existing applications to cloud infrastructure while updating them to take full advantage of cloud features. This allows apps to scale easily, run faster, and be accessed from anywhere. It also improves security and reduces the cost of maintaining physical servers.

Ramsha Khan

Dec 11, 2025

Enterprise Application Development: A Complete Guide fo...

If you’re sitting in the C-suite, you already know this: the business landscape in 2026 demands agility, integration, and relentless efficiency. It’s no longer enough to patch together legacy systems and hope they talk to each other.

What is required is a full-scale strategy for Enterprise Application Development Services, which forms the basis of your business operations, innovations, and growth.

Let’s investigate the perspective that modern enterprises should have towards the implementation, deployment, and development of enterprise applications. It does not matter whether your focus is on core software, mobile applications, web applications, cloud integration, or a combination of all of them. We are working towards shifting the narrative from: We should build an app. To: We have a full enterprise app ecosystem powering everything.

By the end, you’ll not only understand what needs to happen, but how to act, so you can brief your team or vendor and execute with confidence.

However, if you’re new to the app development sphere, here’s what an enterprise system is and how it can help your business scale like never before:

Enterprise Application Development is the method through which the large-scale software systems get designed, built, and deployed that link an organization as one united digital ecosystem across various departments, regions, and business units.

In contrast to consumer applications that are limited to a single function or user group, enterprise apps are constructed in such a way that they can cope with intricate workflows, large amounts of data, and different security levels and access rights. They integrate the whole HR, finance, operations, supply chain, and customer management departments on one platform, which enables data sharing and decision-making to be done in real-time.

Why do you, as a large organization, invest in enterprise application development in the first place? Obviously, it’s due to the old models of siloed departmental systems, manual data transfers, fractured user experiences, and disconnected mobile/web capabilities that are no longer acceptable. Let’s break the problem down:

You’re not a single-user startup. You serve hundreds or thousands of employees across multiple geographies and business units, including HR, procurement, supply chain, finance, and operations. Yet your software still acts like it was built for only 10 users. That conflict creates inefficiencies.

Your departmental tools are unable to communicate. HR has its own platform, procurement uses spreadsheets or manual solutions, supply chain and inventory systems are legacy, maybe on-premise.

What do these issues result in?

Mobile and web demands are blowing up. Your workforce is remote, hybrid, and international. They expect mobile access, web portals, dashboards, and real-time data. If your enterprise software doesn’t keep up, you suffer productivity losses and user frustration.

Cloud, SaaS, mobile, and security are all converging. If you build only web or mobile systems for specific departments, you risk being outdated. You need an ecosystem approach.

From a business standpoint, operations, compliance, analytics, everything has to integrate. A fragmented IT stack slows decision-making, increases cost, and limits your ability to pivot.

Now, let’s look at the flip side. If you get enterprise application development right, you generate serious value across the board, not just in IT, but in business performance, employee engagement, customer experience, and future-proofing. Here’s what you stand to gain:

Switching from a disconnected system to an integrated enterprise software stack, created through enterprise application development, means no more duplicate work, fewer hand-offs, and the ability to automate more processes. The result is total savings in costs, quicker execution, and decreased errors.

You will have integrated data across various departments like HR, finance, supply chain, and operations, and this will help you to create dashboards and insights. You’re not waiting for reports for days; you’re having the real-time views of what matters.

The modern enterprise application development, mobile, web, and cloud help businesses to be faster. They allow the liberalization of new territories, open new departments, and integrate systems, all without being hindered by the traditional processes of legacy systems.

Today’s employees and customers want modern mobile/web interfaces, smooth workflows, and quick access. Furthermore, the company invests in incredible enterprise mobile app development services and enterprise web app development services will keep users in a good mood and productive.