Latest Blogs

IT Support

Ramsha Khan

Mar 04, 2026

Top 5 Industries That Should Adopt IT Support Outsourcing in 2026

Read More...

Enhancing Real-Time Logistics Visibility with Advanced ...

If you ever questioned why shipment tracking isn’t always precise and reliable, you are asking for Real-Time Logistics Visibility. Customers expect live updates, operations teams want to minimize surprises, and finance aims for predictable costs. Achieving this level of clarity is absolutely possible. With today’s shipment tracking, sensor technology, GPS tracking, and smarter platforms, real-time visibility is finally practical, not just for global giants, but for growing shippers and 3PLs too.

Below, we’ll break down what real-time visibility actually means, how it works, where IoT in logistics fits in, how predictive ETA helps you make better promises, and how to roll it out without blowing up your budget or your processes.

Think of visibility as a single, continuous shipment timeline and transport monitoring event, transport modes, including multiple carriers, and partners, constantly refreshed through connected devices and real-time data streams. Real-time visibility typically covers:

With all that in one place, you get supply chain transparency that’s actually usable, not a stack of spreadsheets that’s out of date by the time you hit refresh.

Legacy tracking depends on inconsistent barcode scans, which is better than nothing; however, it creates large visibility gaps during transfers. Real-time systems, on the other hand, continuously stream data. Small, low-cost devices and vehicle-tracking data for your visibility platform in real time. So you can monitor events as they occur, not only after the fact.

Last-mile delivery can make or break your logistics costs, nearly 41% of the total. This is often where delays, missed schedules, and inquiries like “Where’s my order?” arise. By utilizing real-time visibility, teams can reduce costs by preventing waste, avoiding failed deliveries, rerouting deliveries as necessary, and organizing transfers.

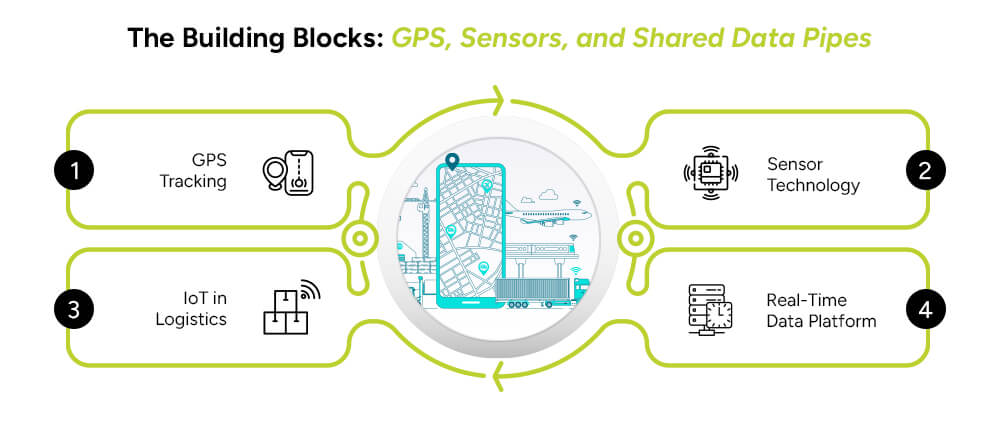

Everything in modern visibility stacks starts with just a few key building blocks:

The explosion of connected devices is what makes real-time affordable and scalable. Research indicates the number of connected IoT devices reached 16.6 billion in 2023 and is expected to grow to 41.1 billion in 2030, a wave that’s directly powering logistics visibility use cases (from trailer tracking to pallet-level monitoring).

Traditional ETAs assume everything will go smoothly, while predictive ETAs use real-time data: traffic, weather, shipping delay, dwell history, driver hours, and lane performance. This dynamic approach helps planners, warehouses, and customers adjust proactively to avoid delays.

With real-time visibility, operational efficiency improves because you’re not longer operating in the dark. Common, measurable wins include:

Even small improvements multiply across lanes, timelines, and teams, turning the last mile into a real source of savings.

Great visibility isn’t a dashboard you admire; it’s a shared view people act on. Best practices:

Freight monitoring extends beyond dots on a map to the physical state of goods. For temperature-controlled shipments, add:

This is visibility that prevents loss, not just reports it after the fact.

Customers don’t judge you by upstream brilliance; they judge you by the doorbell ring. Strong last-mile tracking combines:

Because the last mile drives the largest cost share, it’s also where visibility delivers the fastest ROI.

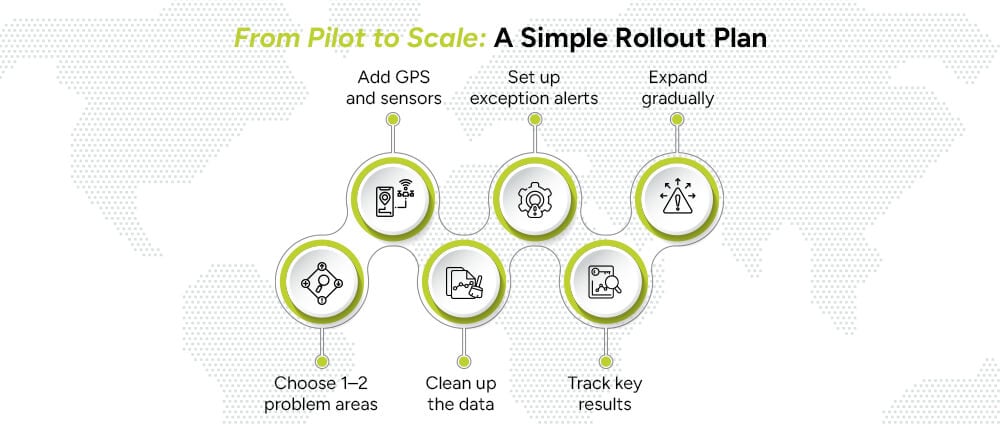

You don’t have to do everything at once. Start small and grow step by step. This is how you can go about developing your logistics app:

Focus on lanes or customers where delays, claims, or “where’s my order?” calls occur most often. Decide how you’ll measure success (like improving on-time delivery or cutting detention fees).

Use vehicle trackers and portable devices to track shipments in real time. For sensitive goods, add sensors that check temperature or handling.

Make sure information from carriers and devices follows the same format. Clean, consistent data makes the system reliable.

Don’t just look at dashboards—set rules so issues go straight to the right person to fix. For example, someone should respond to a delay within minutes, not hours.

Keep an eye on numbers like on-time delivery, ETA accuracy, claims, and customer calls. Share results with carriers and celebrate improvements.

Once it’s working well, roll it out to more lanes, partners, and transport modes. You can even use pallet-level trackers for high-value or fragile goods.

Real-time visibility isn’t a shiny gadget; it’s a control system for your network. It turns uncertainty into manageable exceptions, transforms customer experience, and cuts the hidden costs of firefighting. As the IoT device wave grows and predictive analytics improve, the gap between scan-based tracking and real-time operations will only widen. Teams that move now will set a higher bar for reliability and keep it.

This is where Arpatech can help: by integrating advanced tracking tools, IoT-enabled devices, and predictive analytics into your logistics processes, we make it easier for you to gain true supply chain transparency, boost efficiency, and deliver the kind of customer experience that sets you apart.

Have a free consultation with our developers to rethink, reimagine, and revamp your logistics application development today.

It’s the continuous, live picture of your shipments: location (via GPS tracking), condition (via sensor technology like temperature, shock, tilt, humidity, and light), milestones (pickup, in-transit, out for delivery, delivered), exceptions (delays, route deviations, dwell, excursions), and a predictive ETA that updates as conditions change. Done right, it’s shared across your TMS, WMS, customer portals, and partner networks so everyone acts from the same real-time data.

By shrinking the “unknowns” that cause waste. You’ll lower detention/dwell with earlier notices and better dock scheduling; reduce spoilage and damage with live condition alerts; avoid failed first deliveries with last-mile tracking and proactive customer updates; and trim manual effort by replacing status-chasing with exception queues. These improvements stack up, especially in the last mile, where a large share of logistics costs sits.

Pick a small set of KPIs and track them weekly:

If those curves move the right way as your visibility coverage expands, you’re on the right track.

Ramsha Khan

Sep 23, 2025

Beyond the Last Mile: Optimizing Urban Delivery with AI...

Imagine this: it’s late afternoon, A customer keeps checking their phone to see where their parcel is. The driver is stuck in traffic, struggling to find an apartment building with a confusing entrance. Meanwhile, a logistics manager watches as deliveries take more time and fuel costs rise. This situation occurs repeatedly in millions of deliveries daily. This is the challenge of the “last mile”.

It’s the final stretch of a package’s journey and often the most expensive, unpredictable, and visible part of the delivery process. The good news? AI delivery and automation are rapidly turning this pain point into a playground for innovation, improving speed, cutting costs, and making urban logistics kinder to cities and customers alike.

In this guide, we’ll unpack practical ways to optimize last-mile delivery using AI and automation, explain why this matters for customer experience and sustainability.

Two quick facts that show the scale of the problem: the last mile can account for roughly half of total shipping costs, making it the most cost-intensive part of deliveries.

Also, demand for last-mile delivery is expected to surge; some industry forecasts estimate major growth in parcel volumes by 2030, driven by rising e-commerce and urbanization.

Why is last-mile delivery so challenging in cities? It comes down to a few common problems: congestion, complicated building access, narrow streets, parking limits, unpredictable customer availability, and strict sustainability rules. All of these create variability, and variability is expensive.

AI doesn’t replace delivery know-how; it amplifies it. Here are some realistic ways AI helps:

Traditional delivery plans often assume everything stays the same. In reality, conditions change all the time. AI technology examines real-time factors such as traffic patterns, weather conditions, past delivery times, parcel volumes, and even small patterns, like which streets get busy on market days. Using this information creates dynamic routes that save driving time, reduce miles, and help deliveries arrive on schedule.

Rather than saying “we’ll deliver today,” AI predicts a specific delivery time by combining driver location, route sequencing, and stop-level historical performance. These precise time slots increase the chance of first-time deliveries and leave customers satisfied.

Machine learning can decide in real time whether a drop should move to a nearby van, a bike courier, or a locker, based on capacity, urgency, and sustainability metrics.

Predictive models forecast order volumes at a hyper-local level. That lets companies stock micro-fulfillment centers and pop-up inventories near clusters of demand, slashing the miles needed for final delivery.

AI-driven messaging (SMS, app push, IVR) times alerts to when customers are most likely to respond, offers easy reschedule options, and collects delivery preferences, reducing failed delivery attempts.

When you combine these capabilities, route optimization becomes intelligent, customer experience improves, and operational costs fall.

Automation spreads across physical and digital layers.

There are currently trials of small autonomous shuttles that are self-driving mini-vans for fixed, predictable routes, for example, from a micro-fulfillment hub to a neighborhood hub, and possibly for some area local regulations, curb access, bus parking, AVs may be desirable.

Drones are also suitable for very short, lightweight, and low-traffic corridors, parks, waterfronts, or suburban edges, as accelerating single-item deliveries to surpass ground congestion. However, rules and noise remain limiting factors in dense urban cores.

Including this category, practical automation-adjacent options in congested city centers are certainly the kind that grow agile and emit low emissions while transporting multiple packages from hubs to doorsteps.

That is transferring the last step from doorstep delivery to collection at a secure pickup point. Lockers decrease failure rates and improve efficiency by consolidating multiple deliveries into a single stop.

Internally, automation is speeding up sorting and packing to prepare parcels for optimized routes.

In practice, the best strategy is a mix: human drivers, e-bikes, lockers, and automation technology, chosen based on delivery density, parcel types, and local conditions.

Optimizing last-mile delivery isn’t just a logistics challenge; it’s an urban-planning one, too. Cities that provide loading zones, support micro-hubs, and invest in curb-management systems will make low-emission delivery more efficient. By working together, municipalities and logistics providers can set curb-time windows, establish shared drop-off points, and use common micro-hubs to minimize traffic and delivery-related vehicle emissions.

Sustainable delivery options, electrified vans, e-bikes, and planned consolidation points also help logistics businesses meet corporate sustainability goals while navigating urban restrictions and resident concerns about noise and pollution.

Delivery is now a core part of the product experience. A smooth last mile builds loyalty, while a poor final mile drives customers away. Optimized deliveries reduce missed deliveries, faster ETA accuracy builds trust, and flexible options like time-slot booking, pickup points, and easy returns increase repeat purchases.

In short, improving last-mile delivery isn’t a cost; it’s a way to boost revenue.

If you’re a logistics manager or product owner, here’s a simple roadmap:

Small pilot programs let you learn quickly with a lower investment.

Optimizing routes and using low-emission vehicles can lower fuel use and reduce emissions. This is good for cities and improves a company’s environmental, social, and governance (ESG) profile. Using micro-hubs for deliveries helps cut down traffic in busy urban areas. In many cities, these improvements are no longer optional; they are becoming regulatory requirements.

“Beyond the last mile” is more than a tagline; it’s a mindset. Logistics teams who see the last mile as a systems problem, with inputs from urban planning, local fulfillment, intelligent routing, customer-centric communications, deliver accelerated deliveries with lower costs, happier customers, and eco-friendly cities. AI and automation provide significant support in this transformation, but the real multipliers are practical experimentation: test small, measure honestly, and scale what genuinely reduces miles, delays, and hassles.

At Arpatech, we help businesses design and implement smart last-mile strategies by combining AI-driven route optimization, automation, and customer-focused delivery solutions, ensuring every shipment is not just efficient but also sustainable.

AI improves routing by analyzing large amounts of data (live traffic, historical stop times, delivery priorities, vehicle types, and driver behavior) to create dynamic, real-time route plans. Instead of static daily routes, AI can resequence stops on the fly, balance load across vehicles, and reduce empty miles, leading to faster deliveries, lower fuel consumption, and fewer missed windows. (See earlier examples on dynamic re-routing and predictive ETAs.)

Track a mix of operational and experience KPIs:

Improvement across these measures after an AI/automation pilot indicates effective optimization.

Automation fits at multiple points: warehouse sorting and micro-fulfillment, on-street delivery aides (e-bikes, e-trikes), autonomous shuttles for fixed shuttles, drones for niche corridors, and parcel lockers for final pickup. The best results come from a mixed approach tailored to local density, parcel size, and regulatory environment.

Combine technology and design: provide accurate, narrow ETAs (AI-driven), allow customers easy rescheduling through simple links or apps, offer secure locker/pickup options, use driver apps that capture delivery notes and photos, and communicate proactively with customers about delays. Also, analyze failed delivery patterns and redesign routes or pickup options in high-failure zones.

Ramsha Khan

Sep 18, 2025

Open Banking: Learn about New Opportunities and Revenue...

Open banking is no longer just a regulation-driven project. With the right Open Banking Strategy, it has become a way for banks, fintechs, and businesses to create better services, cut costs, and open new revenue streams.

At its heart, open banking is about data sharing and API integration, letting customers safely connect their financial accounts with apps and services they trust. This shift is building collaborative ecosystems where financial services become more flexible, customer-friendly, and innovative.

Open banking allows customers to give permission for their financial data to be shared securely with other apps or platforms.

For example:

A budgeting app can pull in your bank transactions to give you a full money overview.

A shopping website can let you pay directly from your bank account, skipping the need for a card.

This happens through API integration, which acts as the secure “bridge” between different financial services. The rules for this come from regulatory frameworks such as PSD2 in Europe.

So in short, open banking = safe data sharing + clear customer control + modern financial services.

Open banking adoption is growing quickly:

The UK has already passed 15 million open banking users, with payments being the most popular use case.

Globally, the number of open banking API calls is expected to grow by over 400% by 2025, showing how fast businesses are building on these rails.

This growth proves customers are ready, and businesses are finding real value in payment innovation, lending, and financial insights.

A good Open Banking Strategy starts with customer needs, not just technology. Here are the main steps:

Look at where customers struggle, slow onboarding, high payment fees, rejected loan applications, and design solutions that fix those pain points.

Data sharing must be secure. That means encryption, clear consent, and giving customers control over when and how their data is used.

With smart API integration, businesses can launch faster while staying safe. Keep systems modular so you can add or change partners without starting from scratch.

Work in collaborative ecosystems

Open banking works best when banks, fintechs, and merchants team up. These partnerships drive faster growth and better experiences for customers.

One of the fastest results from open banking is payment innovation. “Pay by bank” services allow customers to pay directly from their bank account instead of using a card.

This is why payment is often the first step in any Open Banking Strategy.

Open banking also transforms how financial services are delivered through data sharing:

Rather than wait days for micro-deposits to verify an account, one can merely log onto their bank, and it’s done instantly.

Lenders are able to assess cash flows in real-time to approve loans and include customers who are previously left out. This is a way of ensuring that there is financial inclusion.

Apps will know more about a personalized savings tips, personalized spending insights, or even personalized investment nudges that may be thrust upon the customer based on what they would have done as behavior.

This is where open banking moves beyond payments and creates new business models.

Businesses are using open banking to launch new business models that generate revenue and customer loyalty:

With consent, businesses can turn transaction data into insights, like income verification for loans or expense tracking for budgeting.

E-commerce platforms and apps can add loans, insurance, or savings features without becoming banks themselves.

Small businesses can pay for tools like automated reconciliation, instant payouts, or cash flow dashboards.

Companies that aggregate bank connections can charge developers or partners for access, support, and premium features.

Each of these models builds on safe API integration and clear regulatory frameworks.

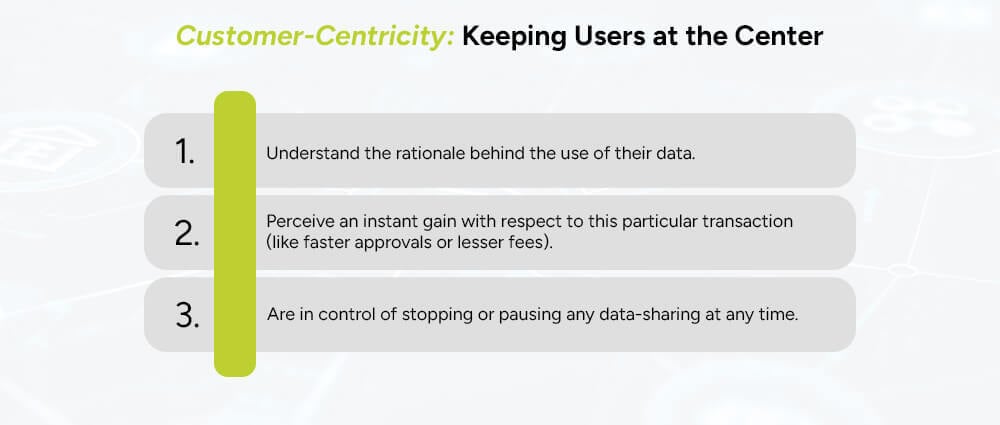

There are two things an Open Banking Strategy must do: customer-centricity. Customers consent to data-sharing only if they:

Putting transparency and control in the hands of the user creates trust and enhances long-term loyalty.

Regulations may seem like a burden, but they create the foundation for trust. Regulatory frameworks ensure:

By treating compliance as part of product design, companies can move faster and stand out as trustworthy.

Open banking thrives on collaborative ecosystems. No single player can cover everything; banks, fintechs, merchants, and technology providers need each other.

Working together, they create financial services that are faster, cheaper, and more customer-friendly.

One of the most powerful benefits is financial inclusion. With real-time data sharing, people who don’t have long credit histories can still prove their reliability through income and spending records.

For example, a small business with steady cash flow but no collateral can get credit through open banking-powered assessments. This helps underserved groups participate more fully in the financial system.

Many businesses ask: how do we earn money from open banking? The answer often lies in data monetization.

With consent, transaction data can be enriched and sold as insights, for example, risk scoring, spending categorization, or loan decision signals. The key is to ensure that customers also see value, so the exchange feels fair.

This creates a win-win: businesses generate income, while customers get faster, more relevant services.

Open banking is no longer only about compliance; it’s about opportunity. With the right Open Banking Strategy, secure API integration, and customer-first design, businesses can now adapt new business models, expand financial inclusion, and create real value through payment innovation and data monetization.

By building strong collaborative ecosystems and working within clear regulatory frameworks, financial services can evolve into something smarter, faster, and more human. This is where Arpatech can help by guiding you through strategy, building secure integrations, and creating scalable digital solutions that turn open banking into real business growth.

Through encryption, tokenization, and secure API integration. Customers should always be in control of what data is shared and for how long. Strong regulatory frameworks also provide protection.

The biggest challenge is aligning incentives. Banks pay for the infrastructure, but fintechs and merchants often see the most benefits. Clear partnerships and shared revenue models in collaborative ecosystems help solve this.

Ramsha Khan

Sep 16, 2025

The Digital Fortress: Building Security in Fintech Solu...

If money makes the world go round, Fintech Security keeps the wheels from flying off. Whether you’re building a payments app, a robo-advisor, or a lending platform, customers hand you their most sensitive data and expect secure transactions by default. The challenge is that attackers adapt quickly, regulations keep evolving, and users won’t tolerate clunky experiences.

That’s why Fintech Security isn’t just a “tech feature”, it’s the foundation of trust between companies and their users.

This is your guide to building what we’ll call a digital fortress: a system that protects users from threats, complies with regulations, and makes people feel confident every time they use your app.

Let’s face it, fintech companies are prime targets for hackers. Why? Because money and personal data are directly involved. A single weak spot can result in stolen identities, drained accounts, or major fraud, ultimately eroding trust overnight.

The impact of a breach isn’t just technical; it’s financial and reputational. According to IBM, the average cost of a data breach in 2025 was around $4.4 million, and that doesn’t even count the loss of customer trust.

On top of that, Verizon’s 2025 report shows that 88% of web application attacks happen because of stolen logins. That means the weakest link is often just a password!

These numbers tell us one thing: cybersecurity in fintech is not optional; it’s survival.

To build strong data protection systems, fintechs need to think like attackers. That means:

This “fortress mindset” keeps you one step ahead.

Financial data is as precious as gold. Here’s how fintech should protect it:

Use strong encryption so data is scrambled when stored and while moving across networks. Even if hackers grab it, it will look like nonsense.

Not every employee needs to see everything. Limit who can view sensitive information, and record every access attempt.

Don’t let private details slip into logs, analytics, or third-party apps. Set rules to stop sensitive information from “leaking out” unnoticed.

By making encryption and strict data privacy policies part of your foundation, you’re already raising the walls of your fortress.

Let’s be honest, passwords are weak. People reuse them, write them down, or choose easy ones. That’s why fintechs are moving towards stronger login methods:

This way, you keep logins smooth but also add smart layers of fraud prevention.

Fraud is one of the biggest threats to fintech platforms. However, here’s the catch; there are too many security checks can frustrate users. The solution? Balance.

If done right, fraud prevention happens in the background and only surfaces when necessary, keeping secure transactions smooth and user-friendly.

Fintech apps rely on many third-party tools, cloud services, and code libraries. That’s why hackers often try to attack the “supply chain” instead of the app directly. To protect against this:

Think of it like checking every brick before building a wall, because one bad brick could collapse the whole thing.

There’s a lot of hype around blockchain security in fintech. While it’s not a magic fix, it can help in important ways:

But blockchain comes with its own challenges. Smart contracts must be coded perfectly because even a minor bug could be disastrous, and securing digital wallets is critical.

Even the best systems can face issues. The key is catching problems early:

The faster you respond, the less damage attackers can do.

Fintechs operate in one of the most regulated industries. Following regulatory compliance isn’t just about avoiding fines; it’s about protecting customers.

The best way to stay compliant is to adopt frameworks:

By building controls around these frameworks, you’ll stay prepared as laws and rules keep changing.

Security and data privacy go hand in hand. Here are a few golden rules:

This makes your system safer and shows customers you respect their privacy.

No matter how advanced your technology gets, people can be the weakest link. A careless click or a stolen laptop can open the gates. That’s why:

Strong human habits add another layer to your digital fortress.

Here’s a simple list every fintech should follow:

Think of these as the walls, gates, and guards of your digital fortress.

Fintech security is by no means an easy matter but it is ultimately a matter of trust. Users expect their money and personal information to be secure but at the same time they do not want to be inconvenienced by prolonged security checks. Fintechs can offer the best of both worlds through the mix of cybersecurity, intelligent fraud prevention, biometric authentication and adherence to worldwide standards.

And remember: a fortress is never “finished.” Security requires constant updates, monitoring, and improvements as threats evolve. This is where Arpatech can help. With our expertise in fintech security solutions, risk management, and regulatory compliance, we build scalable, future-ready systems that not only protect sensitive data but also enhance the user experience. From implementing strong encryption to designing adaptive fraud detection and secure cloud architectures, Arpatech partners with you to turn security into a true business advantage.

At minimum: encryption, strong authentication (biometrics or FIDO2), least-privilege access for employees, fraud detection tools, secure APIs, monitoring for unusual activity, and compliance with frameworks like PCI DSS.

Use adaptive security. For normal, low-risk actions, keep the experience fast. For risky ones (like large transfers), step up with biometrics or extra checks. This way, most users stay happy while fraudsters are stopped.

NIST Cybersecurity Framework (CSF) for overall risk management, and PCI DSS if you handle card payments. These give fintechs a structured way to prove they’re secure and compliant.

Yes. The blockchain changes the game for the records by making them tamper-proof, increasing transparency, and granting the possibility of smart contracts for secure transactions. Nonetheless, the technology demands robust coding, wallet security, and proper handling. Consequently, it’s a beneficial instrument, but not a cure-all.

Ramsha Khan

Sep 11, 2025

How Blockchain Smart Contracts Are Revolutionizing Insu...

If you’ve ever filed an insurance claim, you know the drill: forms, back-and-forth emails, waiting for verification, then waiting some more for payment. In 2025, that experience is getting a serious upgrade. The catalyst? blockchain smart contracts insurance solutions that bring automated claims processing, trust, and transparency to every step.

Think of a smart contract as a tiny program that lives on a blockchain. It holds the rules of your policy (what’s covered, how much, under what conditions) and it can automatically run those rules when certain events happen. Instead of humans pushing paper, software enforces the policy. The result is blockchain claims automation that shortens timelines, reduces disputes, and helps carriers scale efficiently.

Let’s unpack how it actually works, and where it’s already making a difference.

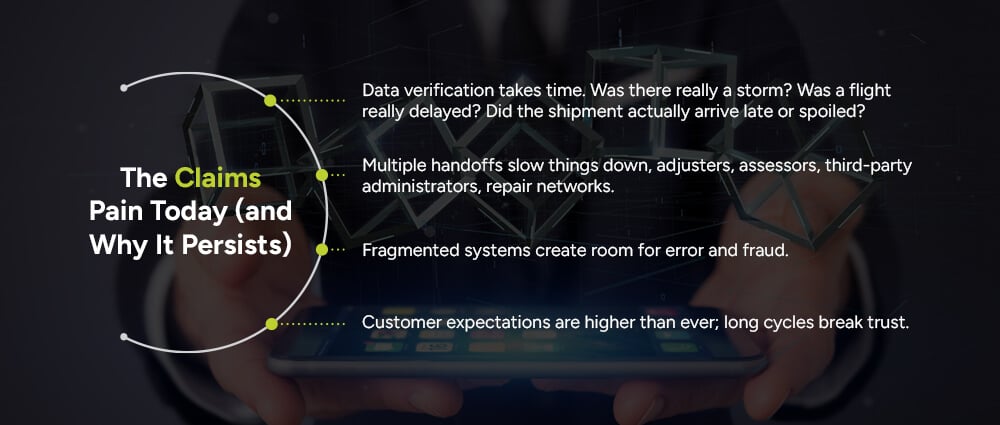

Modern insurers have big investments in digital claims management, but several challenges persist:

To better understand the challenge, consider one current benchmark: J.D. Power reported that U.S. auto repair cycle times during 2024 averaged 18.9 days later in the fielding period, down from 23.9 days earlier, but still weeks of waiting for many customers.

That context matters: any insurance technology innovation that can reduce verification time, automate payouts, and remove redundant steps represents a significant improvement.

A smart contract is basically the policy logic turned into code and deployed on a blockchain. Here’s how that changes the game for digital insurance transformation:

The rules you see in your policy PDF, deductibles, coverage limits, and exclusions, become program logic. If X happens and the evidence meets condition Y, the contract triggers outcome Z. This is insurance process optimization at its core.

Smart contracts don’t guess. They wait for cryptographic proof or reliable data from oracles (secure data bridges) to confirm an event. This is the backbone of blockchain claims verification.

Once the trigger is verified, the contract can initiate automated insurance settlements: releasing a payment, notifying a bank, sending instructions to a repair partner, or updating the claim’s status. Manual intervention occurs only for exceptions.

All decision steps are recorded, reducing disputes and simplifying compliance. Auditors can easily verify what happened, when it occurred, and why.

The result: actual blockchain insurance efficiency. There is less back-and-forth, fewer manual checks, quicker decisions, and consistent outcomes.

Smart contracts shine brightest in smart contract use cases, such as insurance, where the loss event is objective and data-driven. That’s why parametric products, policies that pay when a measurable trigger occurs, have become the poster child for blockchain claims automation.

These are high-fit use cases because the truth lives in data, exactly what smart contracts consume.

Here’s what the process typically looks like when implementing a smart contract for insurance claims:

A data oracle provides secure, tamper-resistant feeds like weather readings, IoT sensor data, shipping milestones, flight schedules, mortality records, or verified documents. Smart contracts monitor these inputs and automatically act when predefined thresholds are met.

The smart contract compares incoming data with the policy logic: “Was rainfall under 10 mm for 15 consecutive days?” “Was the shipment temperature above 8°C for more than 30 minutes?” This is the blockchain smart contracts insurance brain at work.

When conditions are met, the contract executes actions such as initiating payment, notifying stakeholders, closing the claim, or triggering further checks. With automated claims processing, settlement can be almost in real time, with support for simple cases.

Case studies highlight the importance of secure oracles that supply smart contracts with tamper-resistant data, especially in parametric models where automation is a key feature.

The benefits for policyholders are straightforward: faster claims and more certainty. With smart contract insurance, customers experience:

For insurers, optimizing the claims process means lower handling costs, smoother customer experiences, and the ability to free adjusters to focus on complex claims.

One forward-looking benchmark: McKinsey predicts that by 2030, more than half of current claims activities could be replaced by automation, a signpost for the industry’s direction and a strong rationale for investing in claims automation now.

You’ll see the earliest and cleanest wins in lines of business with objective data triggers:

As confidence increases, insurers are incorporating smart contracts into traditional indemnity claims. They use blockchain to verify documents, log adjuster decisions, manage vendors, and automate partial payments during repairs. This represents a real-world example of hybrid digital claims management in action.

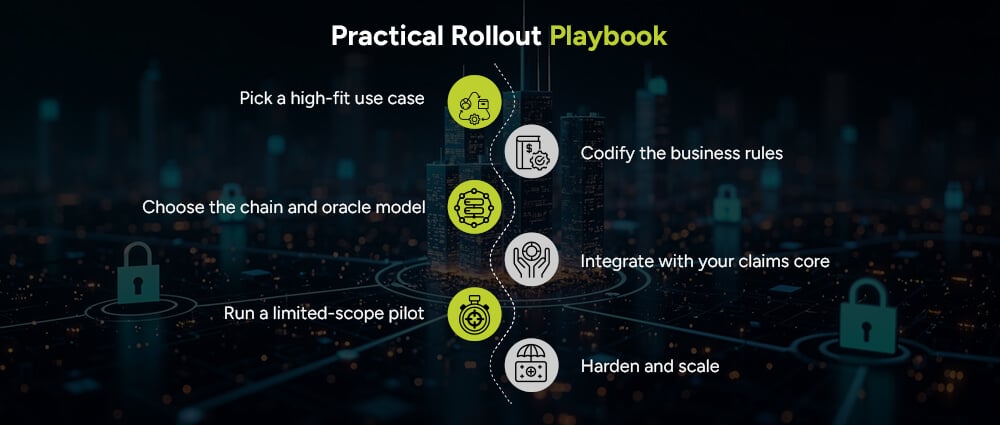

A practical smart contract implementation insurance blueprint usually looks like this:

Insurers don’t need to move their entire tech stack to blockchain.Instead, many are simply integrating a smart-contract layer that connects to existing systems through APIs, providing an incremental approach to digital insurance transformation.

Smart contracts are code, so treat them like critical software:

Done right, GRC becomes a blockchain insurance efficiency driver, not a blocker.

Even with clear benefits, executives want numbers. Teams can justify their investment by highlighting:

Remember our baseline: multi-week auto claim cycles are common today, and projections indicate that a significant portion of claims activity will trend toward automation by 2030. These two facts alone provide a compelling case to pilot blockchain claims automation now.

A successful smart contract implementation relies on an iterative, step-by-step approach.

Focus on areas such as travel delays, weather-based policies, objective triggers, and reliable data.

Convert policy text into specific rules with conditions like thresholds, time frames, and coverage limits.

Permissioned vs. public with privacy layers; single or multiple data oracles; fallback logic for missing data.

Connect read/write APIs to your FNOL intake and other systems, using lightweight middleware for event orchestration.

Conduct a Pilot

Implement a pilot with real customers and payouts in a limited area, measuring speed, service, dispute rates, and customer satisfaction.

Incorporate additional data feeds, expand geographical coverage, and introduce hybrid models that automate certain aspects of indemnity claims, such as document checks and payment triggers at specific milestones.

By following this approach, you can transform“innovation theater” into tangible improvements in insurance process optimization.

By 2025, smart contracts will transition from concept to core capability. When you strip away the buzzwords, you’re left with something both simple and powerful: policy rules that enforce themselves when trusted data says it’s time. That’s the essence of blockchain smart contracts insurance, and it’s why customers and carriers are feeling the difference.

Use cases that leverage objective, third-party data are already showing significant results, while more complex claims are benefiting from automated checkpoints that reduce processes and accelerate settlements. With only a modest effort required to integrate, insurers can unlock faster, fairer, and more transparent claims, exactly what policyholders have wanted all along.

At Arpatech, we help insurers and enterprises bring these innovations to life. From building secure smart contract frameworks to integrating blockchain with your existing claims systems, our team ensures a smooth transition toward digital insurance transformation. Whether you’re piloting parametric covers or modernizing traditional claims workflows, the consultants at Arpatech provide the expertise, technology, and support to make automated claims processing a practical reality for your business.

They automate the busywork. Instead of people collecting and checking evidence step by step, the contract listens for trusted event data (like verified flight delays, weather indices, or IoT sensor readings). When conditions match the policy rules, it triggers actions automatically, like approving the claim or initiating payment. This removes handoffs and compresses cycle time, a major goal of digital claims management and insurance technology innovation.

Common triggers in smart contract use cases insurance include:

Start where proof is objective, and coverage is binary: parametric travel, weather-indexed agri, and cargo/IoT-based policies. From there, layer automation into parts of traditional claims: document checks, milestone-based partial payouts, and vendor orchestration. This staged approach delivers early value while you build toward broader blockchain insurance efficiency.

Ramsha Khan

Sep 9, 2025

Blockchain-Based Parametric Insurance: Instant Payouts ...

When natural disasters strike, time is everything. Whether it’s a hurricane ripping through coastal towns, a flood destroying farmland, or an earthquake shaking a city to its core, people and businesses need financial help… and fast. Traditional insurance processes, however, are often slow, involving paperwork, manual assessments, and back-and-forth communication. That delay can make recovery even harder.

But imagine this: instead of waiting weeks or months for an insurance payout, policyholders could get their money automatically, sometimes within hours of a disaster being confirmed. No lengthy claims process. No delays. Just instant insurance payouts when they’re needed most.

That’s exactly the promise of blockchain-based parametric insurance, a new model that’s changing the future of disaster relief and risk management.

Before diving into how blockchain transforms it, let’s first understand parametric insurance.

Traditional insurance works like this: you file a claim after damage occurs, adjusters inspect the loss, and then your insurer decides how much you’re owed. It’s reactive, time-consuming, and often disputed.

Parametric insurance, on the other hand, doesn’t wait for all that. Instead, it pays out automatically when a predefined event happens. For example:

The payout isn’t based on actual loss verification but on triggers, measurable parameters like weather data, seismic readings, or rainfall indexes. That’s why it’s called parametric insurance.

It’s fast, transparent, and removes much of the back-and-forth that is slowing down traditional insurance right now.

Now, here’s where things get exciting.

Adding blockchain technology to parametric insurance makes it even more powerful. Using smart contracts, insurance payouts can be fully automated. A smart contract is like a self-executing digital agreement that triggers once conditions are met.

So, if satellite weather data confirms a flood in a certain region, the smart contract parametric insurance program on the blockchain instantly releases funds to all affected policyholders. No human approval required.

You get no delays, no waiting for manual approvals. Payouts happen automatically, whenever something goes wrong.

All conditions and transactions are visible on the blockchain, leaving no room for disputes from policyholders or insurance companies.

Policyholders get to have blind trust as they don’t have to “trust” the insurer’s word; the contract executes as coded.

Eliminates paperwork and reduces administrative costs, streamlining the work and bringing reliability to the operations during a dire time.

That’s why parametric insurance blockchain technology is being hailed as one of the most important innovations in digital insurance solutions.

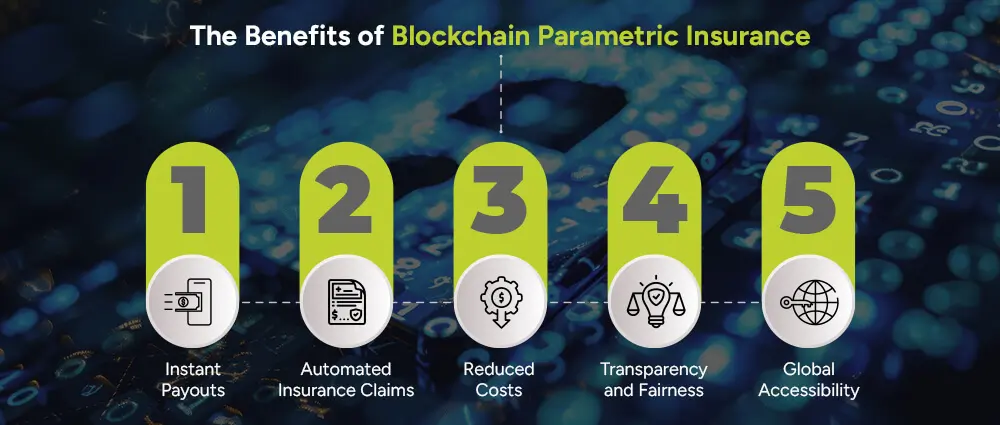

Let’s break down the key benefits in a simple way:

The biggest assurance is an instantaneous insurance settlement. This can definitely change lives of those suffering beyond their control. Farmers are fed with the seeds for the next season, families get home far from disaster zones, and businesses catch up on their operations without being paralyzed due to delays.

Automated insurance claims would eliminate further actions like filing, waiting for adjusters, and settlements. This alleviates the process, rendering it fast and non-stressful.

Fewer intermediaries and administrative costs mean that insurers can lower costs and pass these financial blessings onto the most deserving in terms of policyholders.

Due to the blockchain, the nature of the finances, including the exact data triggers, becomes very clear indeed, utterly decimating disputes. Each one knows right from the start.

With parametric insurance platforms powered by blockchain, insurance can reach underserved regions. Farmers in developing countries, for example, could benefit from blockchain crop insurance that protects them against droughts or floods.

This isn’t just theory, it’s already happening.

Weather events cause billions in damages every year. With blockchain weather insurance, payouts are tied to objective weather data, such as rainfall or wind speed. If the data confirms the trigger, money flows instantly to those affected.

Farmers are among the biggest beneficiaries. Blockchain crop insurance allows them to protect their livelihoods against unpredictable weather. Imagine a farmer in Africa automatically receiving funds after a season of low rainfall, without ever filing a claim. That’s transformative.

For earthquakes, floods, or hurricanes, blockchain ensures automated disaster claims are processed instantly. This helps governments, businesses, and individuals bounce back faster after a disaster.

Businesses in logistics, tourism, energy, and media sectors are also using blockchain parametric insurance benefits. A shipping company, for example, could insure against port closures caused by storms and receive an instant payout when thresholds are breached.

The beauty of blockchain insurance innovation lies in how it enhances trust and automation.

In traditional insurance, trust depends on intermediaries. You trust the insurer, the adjuster, and even the reinsurance company. In blockchain parametric insurance, trust is transferred to code and data.

Smart contracts automatically verify whether the event occurred using trusted data sources like satellites, sensors, or meteorological agencies. Once verified, the payout is triggered instantly.

This eliminates the risk of fraud, mismanagement, or delay.

Of course, no system is perfect. For all its promise, parametric insurance blockchain technology still faces some challenges:

The system depends on reliable data sources. If data is faulty or manipulated, payouts could be unfair. So, data integration with blockchain is quite useful.

Sometimes, policyholders may suffer losses even though the parametric trigger wasn’t met (for example, a farmer whose field is flooded but rainfall didn’t cross the set threshold). This mismatch is called basis risk.

Insurance is heavily regulated, and blockchain-based solutions may face compliance challenges across different countries.

While the idea is strong, widespread adoption requires education, infrastructure, and trust in digital systems.

Despite these challenges, the momentum is undeniable. Many insurers, startups, and global institutions are already testing and rolling out parametric insurance platforms using blockchain.

We’re standing at the edge of a revolution in the insurance industry. Natural disasters are increasing in frequency and severity due to climate change, making fast financial recovery more important than ever.

Blockchain parametric insurance is not just a new product, it’s a shift in how insurance is designed, delivered, and trusted. It’s an example of how digital insurance solutions can close the gap between disaster and recovery.

From protecting farmers’ crops to helping small businesses survive storms, from covering entire communities to ensuring governments can respond quickly, this model has the potential to reshape global disaster response.

See how Arpatech can shape the emergency landscape and help in fast and efficient disaster recovery. Get insurance plans that are automated and software that don’t require attention, automate your recovery to get back on your feet as fast as possible.

Blockchain ensures automation, transparency, and trust. With smart contracts, payouts are executed instantly once conditions are met. This removes human delays, reduces fraud, and builds confidence in the system.

Carriers should watch for basis risk (when losses don’t perfectly match triggers), data reliability (ensuring sensors and weather stations are accurate), and regulatory compliance across different markets.

The strongest early use cases are in weather-based risks such as drought, flood, and hurricanes. That’s why blockchain weather insurance and blockchain crop insurance are already being tested widely. These areas have clear, measurable parameters and deliver high value to communities most vulnerable to disasters.

Ramsha Khan

Sep 4, 2025

Mobile DevOps App Integration: Key to Faster, Smarter...

Mobile apps today aren’t just for advanced organizations; they’re the lifeblood of customer engagement, business growth, and brand loyalty. So, from stuff like ordering food to getting rides, mobile banking, and keeping track of our health, apps have changed the way we live, work, and connect with others. But behind all the ease with which these apps work lies a world of complex code, infrastructure, and operations. That’s where mobile devops app integrations come into play.

Traditionally, app development and infrastructure management were completely distinct: a developer developed an app, but IT teams managed servers and deployments. But gaps have created bottlenecks, as mobile apps became more complex and user expectations began to rise. Mobile DevOps is now at work to close that gap, bringing development to infrastructure and operations in order to deliver faster, smoother, and more reliable apps.

Next, we are going to discover what exactly Mobile DevOps is, the way it contributes to the process of iOS and Android application development, what problems it clears, and how to put actions on it in your business. Let’s go deeper.

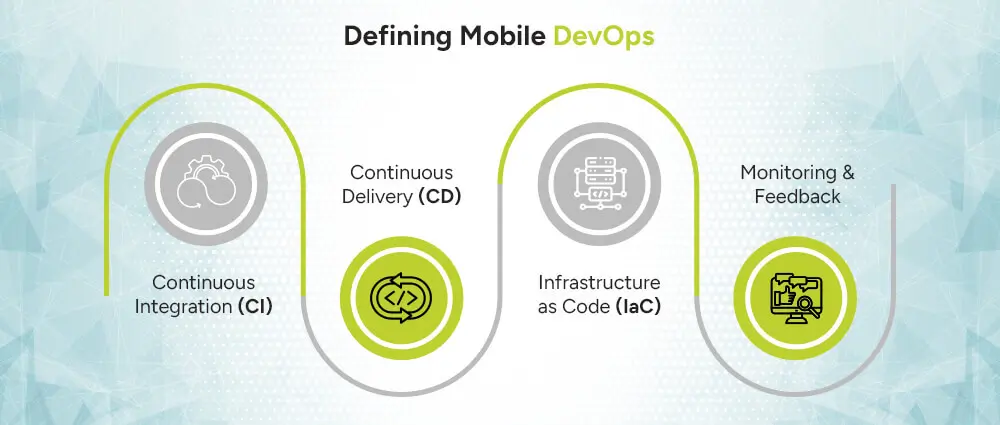

Before we go further, let’s answer the core question: What is Mobile DevOps in iOS and Android App Development?

In simple terms, Mobile DevOps is the practice of applying DevOps principles, automation, collaboration, and continuous delivery to mobile apps. It ensures that mobile app development and operations teams work together seamlessly across the app lifecycle.

Where traditional development might rely on isolated processes, Mobile DevOps best practices emphasize:

This approach isn’t just about tools; it’s a cultural shift. It makes developers, QA testers, operations engineers, and even business stakeholders part of the same journey.

You may be wondering, can’t we just apply the same DevOps trends that we use for web or desktop apps? Not quite. Mobile apps come with their own unique set of challenges:

Development is frequently done in tandem for iOS and Android, across various programming languages, SDKs, and deployment scenarios.

Mobile apps must be put through the App Store or Google Play Store review process, resulting in mandatory delays, unlike web apps that always deploy on demand.

Most notable on Android, this [diversity or plurality] becomes even more overwhelming with different screen sizes, OS versions, and thousands of hardware configurations that a developer has to accommodate.

Most mobile applications are expected to be functional in an offline condition or under a low connectivity environment, increasing the complexity of testing scenarios.

People expect their mobile application to load within 2 seconds and never crash. In fact, a Statista report states that 25% of applications are abandoned after the first use, which is intimidating.

These differences highlight why traditional DevOps doesn’t fully fit mobile development, which brings us to the next point.

Traditional DevOps, designed with server-side and web applications in mind, often struggles in mobile contexts because:

This is why mobile DevOps app integration needs specialized workflows, business intelligence tools, and strategies.

So what’s the actual role of DevOps in mobile app development? At its core, DevOps ensures that developers can build and deliver apps quickly while operations teams ensure those apps run smoothly on real devices. Together, this means:

Think of it this way: developers build the car, operations maintains the roads, and DevOps is the bridge ensuring the car reaches its destination without bumps.

If you’re working with a DevOps and mobile app development company, here’s what you stand to gain:

To put this in perspective, Puppet’s 2023 State of DevOps report found that high-performing DevOps teams deploy software 208 times more frequently than low-performing teams. For mobile apps, that’s the difference between being the market leader or playing catch-up.

You can’t talk about Mobile DevOps without mentioning tools. Some popular DevOps tools for mobile app development include:

The right combination depends on your app’s size, team expertise, and budget.

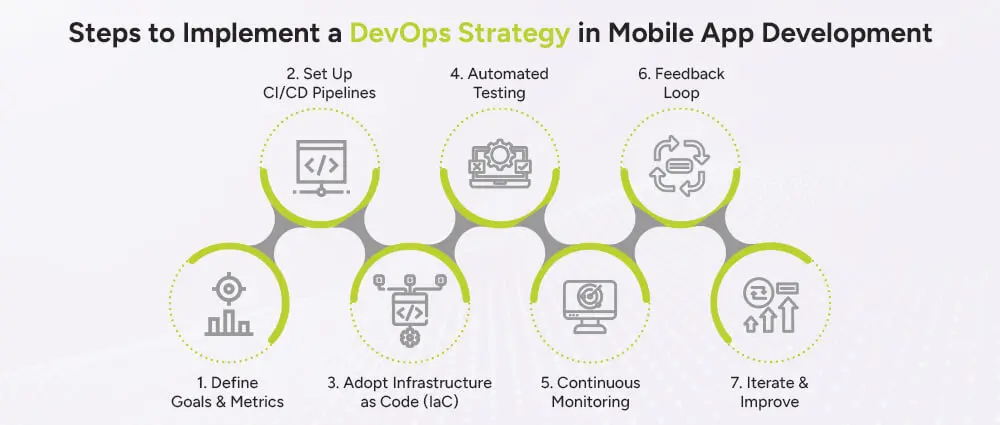

Here’s a simplified roadmap for adopting DevOps in your mobile app projects:

Establish the goal – be it speed versus stability or user experience – and measure the performance through KPIs such as build success rate or crash-free sessions.

Automate the entire build-test-deploy cycle to enable quicker and far more reliable releases, using tools such as Jenkins, Bitrise, or GitHub Actions.

Scripting of the Infrastructure using Terraform or AWS CloudFormation in order to ensure backend environments that are consistent and scalable.

Add unit, integration, UI, and device tests with products like Firebase Test Lab to ensure app stability at the device level.

Catching crashes, performance, and user failing with tools like Crashlytics or New Relic keeping an eye on the issue before the users do.

Promote collaboration between developers, quality assurance, operations, and DevSecOps teams by using shared dashboards and automated alerts.

Our pipelines, tests, and monitor systems will be continuously optimized to meet the higher and very much new demands from devices, OS updates, and user expectations.

This roadmap outlines how to get started with Mobile App DevOps in practical steps.

In a company engaged in DevOps and mobile app development, responsibilities are usually shared, although they may include:

Thus, this collaborative model ensures that no team works in isolation.

For newbies, here are some pointers:

Mobile DevOps app integration isn’t just a luxury for advanced apps anymore; it’s a necessity in today’s app-driven world. Traditional DevOps models weren’t built for the unique challenges of mobile, but Mobile DevOps bridges the gap between app development and infrastructure management. By adopting the right culture, tools, and processes, businesses can achieve faster releases, better quality, and happier users.

Outsource your DevOps to the right people, and work with the ideal DevOps Services and team if you’re serious about scaling your mobile app, the question isn’t if you should adopt DevOps, it’s when. Let the team at Arpatech help you develop your next mobile app.

Yes, DevOps principles help in faster delivery, app stability, and user satisfaction, whether you are building a simple utility app, a gaming app, or an enterprise-grade solution. The core benefit exists regardless of the scale and complexity of the implementation.

The cost of implementing DevOps for mobile apps may vary greatly due to the largely differing influences such as the size and complexity of the application, tools and infrastructure you prefer, and whether you go with an in-house team or a consulting partner. Simple projects incur lesser costs and simpler setups, while larger enterprises with complex needs probably pour more money into robust pipelines, advanced automation, and maintenance. In the end, it all comes down to your goal-setting, scalability ambition, and long-term plan.

Look for a mobile app DevOps partner who:

Ramsha Khan

Aug 28, 2025

Implementing DevOps Vulnerability Scanning in a CI/CD P...

Think of your software development process like a manufacturing line. Each step, from writing code to testing, packaging, and releasing, is part of a carefully designed system. If at least one batch of raw materials becomes defective during that process, then its final product reaches the consumer; it has incurred enormous costs of recall, repairs, and damage to reputation.

Similarly, if defects in the source code or third-party components occur after deployment, the fallout they cause on security, compliance, and customer trust can be grave. This serves to explain why it is essential to detect issues early in the CI/CD pipeline; basically, it does like automated quality checks at every stage of the production line.

Today, we are going to delve into understanding what DevOps vulnerability scanning in CI/CD is, the reason or importance of having it, its operation, the different types of scans available in the DevOps world, plus the advantage that it offers.

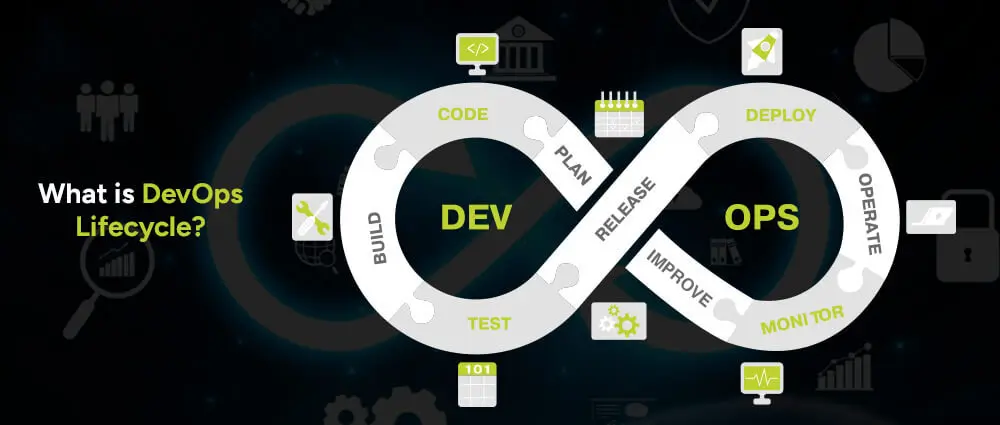

The DevOps lifecycle is usually described as:

Plan → Code → Build → Test → Release → Deploy → Operate → Monitor → Improve.

Security should weave through each stage, ensuring safe delivery at every step.

The question is what DevOps is and its vulnerability scanning CI/CD.

At its core, DevOps vulnerability scanning CI/CD means building security into the same system that developers already use to test and deliver software.

By adding vulnerability scanning into this process, you’re making sure every aspect is safe before the software reaches the customer.

Here’s why security checks can’t be skipped in today’s fast-moving world:

Research shows that 96% of codebases contain open-source software. That means even if your team writes great code, vulnerabilities can sneak in through third-party components.

DevOps encourages frequent releases. Without automated scanning, issues could reach customers much faster than before.

It’s easier and less costly to correct a mistake during development than after it goes live.

Many industries require proof of ongoing security checks to meet standards like PCI DSS or HIPAA.

Studies show the average time to fix high-risk vulnerabilities is about 74 days, that’s over two months of exposure if you don’t have automation helping you.

Let’s keep this simple.

When a developer submits new code, the pipeline automatically starts running tests. Alongside the usual “Does the app work?” checks, security scans run in the background:

If something looks dangerous, like a known weakness in a library, the system flags it. Developers get feedback right away, not weeks later. If it’s a serious problem, the system can stop the release before it reaches customers.

It’s like having a food inspector stationed at every checkpoint in a bakery.

There’s no single scan that covers everything. Different scans look at different features:

Together, these give a full picture of where risks might appear.

So, why invest in this? Here are the real-world benefits teams notice:

Not every tool is created equal. When choosing CI/CD Security Tools, look for:

Even with the best tools, it’s not just about finding problems, it’s about managing them:

This approach is what people mean when they say Vulnerability Management and DevSecOps with CI/CD. It’s about blending security into the daily rhythm of development, not treating it as an afterthought.

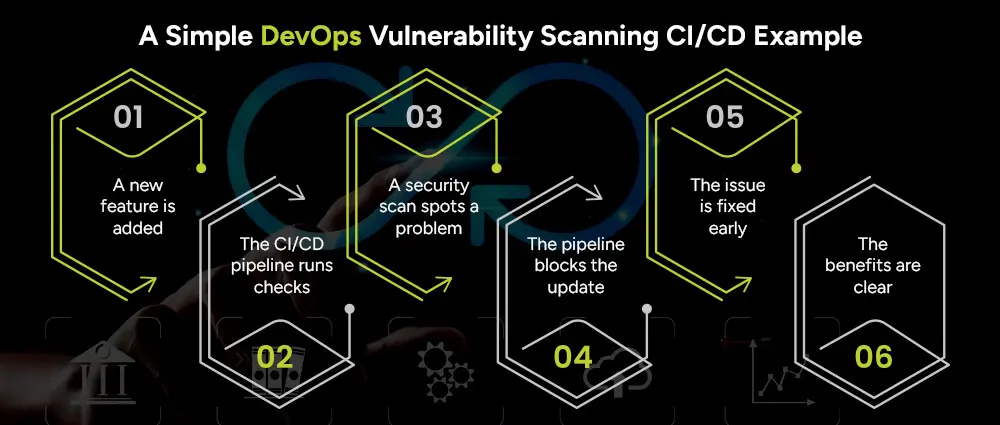

To understand how this works in practice, let’s imagine a mobile banking app.

A developer introduces a new feature, such as fingerprint login, to improve user convenience.

As soon as the code is submitted, the CI/CD pipeline automatically runs its usual checks to make sure everything works as expected.

During these checks, a security scan detects that one of the open-source libraries being used has a known vulnerability.

Instead of letting the risky code move forward, the pipeline stops the update until the library is either updated or replaced with a safe version.

Because the problem is caught right away, the issue is resolved before the app is pushed out to thousands of customers.

This simple example shows how early scanning saves embarrassment, prevents financial losses, and protects the trust of users.

Even with the best intentions, teams sometimes make mistakes when adding vulnerability scanning to their CI/CD pipeline. Here are the most common ones:

Teams often add multiple tools right away, which creates confusion and slows progress. It’s better to start small and gradually scale up, whether you’re a small startup using business intelligence tools or a large enterprise experimenting with new tools.

If every small issue blocks progress, developers get frustrated. A good approach is to begin with warnings and only enforce strict rules once the team is comfortable.

Many teams focus only on the app’s code and forget about cloud or infrastructure settings. These are often the weakest points, so scanning them is just as important.

Sometimes vulnerabilities are logged but never assigned to a person. This means they sit unresolved. To avoid this, make sure each issue has a clear owner.

Implementing DevOps vulnerability scanning in a CI/CD pipeline isn’t about slowing things down; it’s about speeding them up safely. By adding lightweight, automated checks into the development process, DevOps development teams like those at Arpatech can ship with confidence, protect users, and avoid costly surprises.

The key takeaway: Treat security like quality as it’s the trend of DevOps as a service, so we need to build security into the recipe, not the cleanup.

CI/CD stands for Continuous Integration and Continuous Delivery or Deployment.

That is how CI/CD forms the assembly line for modern-day software development.

In a broad sense:

The goal is a high automation quotient, whereby the pipeline can manage such repetitive check-ups and human effort can be focused on solving real problems.

Ramsha Khan

Aug 26, 2025

Making Mobile Apps Smarter with AI-Image & Voice R...

Last weekend, Aisha was rushing to catch her flight. With one hand holding her coffee and the other dragging a suitcase, she simply said, “Hey travel app, check me in for my flight.”

Her travel app recognized her voice instantly, confirmed her booking, and brought up a QR boarding pass on screen.

A few minutes later, at the airport’s shop, she pointed her phone camera at a pair of sunglasses. The app scanned them and instantly suggested cheaper options online, same model, same color, but at half the price.

Neither moment felt extraordinary to her. But just a few years ago, AI-Enabled Image and Voice Recognition Features in Apps like these would have sounded futuristic. Today, they’re so seamless that many users barely notice the complex AI image recognition in apps and speech technologies working in the background.

Top apps today combine computer vision, automatic speech recognition (ASR), and natural language understanding (NLU) to create interactions that feel fast, personal, and (dare we say) a little magical.

Here, we’ll understand the evolution of AI in mobile applications, unpack AI image and voice recognition: core components and technologies, and explore advanced image recognition capabilities and use cases.

Insider Intelligenc found that over a quarter about 26% of U.S. adults currently use or plan to use AI-powered voice assistants on their smartphones, making voice the most popular AI feature on mobile right now.

Mobile AI has gone through three big waves:

Apps captured audio or images and shipped them to the cloud for processing. This enabled early breakthroughs, like accurate voice transcription and object tagging, but it introduced latency and raised privacy questions.

Models got smaller and phones got faster. AI mobile App Developers began running lightweight models on-device for instant responses e.g., wake word detection, face unlock, offline translation, and falling back to the cloud for heavier tasks. This cut network costs and made features more resilient.

With NPUs integrated into mainstream chips, phones increasingly run image and voice models locally for summarization, translation, scene understanding, and multimodal search. The promise: snappier UX, stronger privacy, and smarter features that work even with a spotty signal. Analysts expect this trend to accelerate as phones ship with silicon specifically optimized for AI workloads.

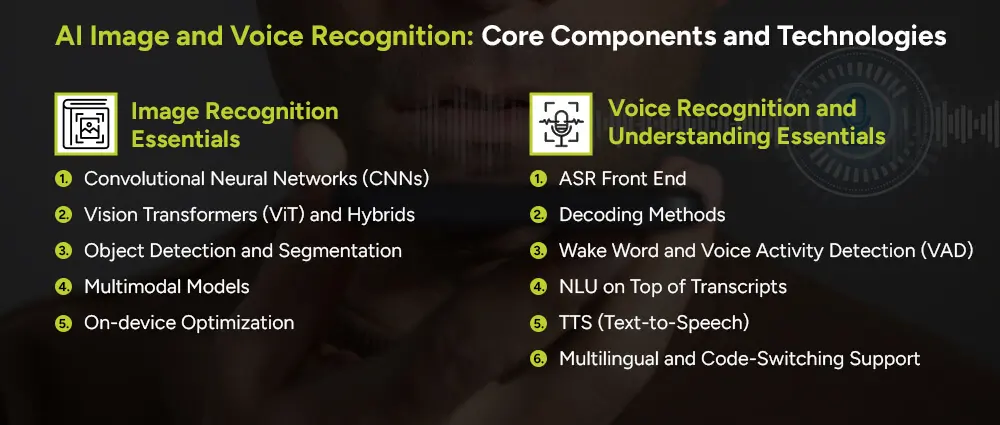

Both modalities rely on a similar foundation, representation learning, but the details differ:

The main technology for identifying images and extracting features. Examples include ResNet and EfficientNet.

Transformers break images into patches and use attention to find patterns. They often match or beat CNNs on large datasets and are easier to scale.

Models like YOLO and DETR can detect objects and draw boxes around them. Mask R-CNN and SAM go further, identifying the exact pixels for each object.

Systems like CLIP connect images and text in the same space. This enables features like visual search, like asking “find shoes like this,” and smart captions.

Techniques like quantization, pruning, and distillation make AI models smaller and faster so they can run smoothly on mobile devices.

Automatic Speech Recognition (ASR) converts audio into text. Modern systems use Conformer models for more accurate results, replacing older approaches.

CTC, Transducer, and Attention decoders help align audio with text efficiently and accurately.

Small models listen for trigger phrases like “Hey Siri” and detect when you start speaking. These usually run on-device for speed and privacy.

Natural Language Understanding (NLU) takes the text, figures out the intent, and pulls out key details to complete actions.

Turns text back into natural-sounding voices, making assistants conversational.

Essential in places where users mix languages in one sentence. Modern models handle this much better than older systems, which is why app modernization is highly essential for SMBs and large-scale businesses today.

You don’t need to build a full Siri. Start with small wins and scale.

1) Define your voice moments

Figure out where speaking is better than tapping. Examples include:

2) Decide where AI runs

3) Build the pipeline

4) UX considerations

5) Privacy and trust

Voice is already popular on mobile. In fact, 26% of U.S. adults use or plan to use AI-powered voice assistants on their smartphones (YouGov/Insider Intelligence). Designed well, voice can become the most natural and convenient way for users to interact with your app. (EMARKETER)

Image recognition has moved far beyond “is this a cat?” Here’s where teams are gaining traction:

Shoppers snap a picture and find similar items; travelers point their camera to identify landmarks. Multimodal embeddings (think CLIP-like) power “find me something like this” experiences that boost conversion and retention.

Face and hand tracking enable makeup try-ons, eyewear fitting, ring sizing, and clothes try-on in the retail and ecommerce business. Scene geometry estimation and segmentation let users preview furniture at scale in their living room.

Healthcare professionals pose estimation tracks form during workouts; dermatology apps flag lesions to discuss with a clinician; diet apps recognize packaged foods and nutrition labels.

From a market standpoint, computer vision is one of AI’s fastest-moving domains. Analysts track rapid growth as industries adopt vision for automation and edge use cases.

Recognition is just the beginning. The real value comes when your app adapts to users in the moment. Context-aware UIs can detect a document and switch to “Scan” mode, or change language settings if the user speaks in Urdu. Apps can remember frequent actions and suggest them, summarize bursts of photos or voice notes, and connect user-captured images to relevant catalog items. The key is to personalize in a helpful, transparent way while giving users control.

Architecture choices: where AI runs

A mix of on-device and cloud processing. For example, detect wake words locally, then send complex or uncertain requests to the cloud. Sensitive tasks can be checked in both places.

With more GenAI-capable smartphones and better NPUs, more AI features can run locally each year, improving speed, privacy, and user trust.

Soon, you’ll be able to select a photo album and ask your phone to create a story with highlights, all without using the cloud. With more powerful NPUs, this will be possible for everyday users.

App frameworks will adapt to your needs while keeping your data on your device, thanks to technologies like federated learning and differential privacy.

On-device speech-to-speech translation with voice cloning (with consent) will make conversations in different languages smooth and natural.

From phone cameras to wearables, apps will understand what you see and do, enabling training, repair, and accessibility tools.

App stores and device makers will offer pre-built AI model bundles, making it easier for developers to add vision, voice, and other capabilities.

AIaaS tasks will be scheduled smartly to save battery, running heavy processing when plugged in and scaling back when needed.

Built-in tools for consent, audit logs, and data handling will help developers meet privacy and compliance standards. Therefore, whether you’re in the fintech, banking, or healthcare sector, you’ll always be goodwith compliance on all ends.

AI works by learning patterns from data and applying that knowledge to new situations.

For images, AI models are trained on millions of pictures to recognize things like edges, textures, shapes, and overall context. Modern systems like Convolutional Neural Networks (CNNs) and Vision Transformers turn raw pixels into meaningful information. This allows apps to classify what an image contains, detect specific elements, separate regions of interest, and even find similar items.

For speech, AI listens to sound patterns over time and learns how they map to words, even with background noise or different accents. Advanced models such as Conformer/Transducer can recognize speech in real time, while natural language understanding (NLU) models interpret the meaning and extract details like amounts or names.

With more data and faster hardware, today’s smartphones can perform this recognition almost instantly. On-device AI is becoming standard, making the process faster, more accurate, and more private

The key to building AI-powered mobile experiences is to start small but smart. Focus on one high-value user journey, such as scanning receipts and extracting totals or enabling voice-controlled playback. Prototype using ready-made AI models or APIs and test on your target devices to ensure speed and accuracy. Decide what runs on-device and what runs in the cloud, then optimize with techniques like caching.

Build a smooth fallback for when AI is not perfect, then launch to a small group, gather feedback, and make improvements. Over time, expand with features like multilingual support, personalization, and multimodal search. Continuously test in different lighting, noise, and accent conditions while keeping privacy as a top priority.

When done well, users will feel like your app just works, delivering a fast, helpful, and secure experience. At Arpatech, we specialize in integrating AI seamlessly into mobile apps. Let us help you bring your next smart app idea to life.

AI enhances visuals by improving capture quality (clearer low-light and motion shots), automating tasks (detecting documents, fixing perspective, running OCR), personalizing content (curated galleries, smart edits), and boosting accessibility (scene descriptions, object recognition). It also makes AR more realistic with accurate depth and segmentation.

Image: Convolutional Neural Networks (CNNs) and Vision Transformers (ViTs) for classification, detection, and segmentation.

Speech: Conformer-Transducer for streaming recognition, paired with transformer-based models for understanding context.

Ramsha Khan

Aug 19, 2025