When natural disasters strike, time is everything. Whether it’s a hurricane ripping through coastal towns, a flood destroying farmland, or an earthquake shaking a city to its core, people and businesses need financial help… and fast. Traditional insurance processes, however, are often slow, involving paperwork, manual assessments, and back-and-forth communication. That delay can make recovery even harder.

But imagine this: instead of waiting weeks or months for an insurance payout, policyholders could get their money automatically, sometimes within hours of a disaster being confirmed. No lengthy claims process. No delays. Just instant insurance payouts when they’re needed most.

That’s exactly the promise of blockchain-based parametric insurance, a new model that’s changing the future of disaster relief and risk management.

Before diving into how blockchain transforms it, let’s first understand parametric insurance.

Traditional insurance works like this: you file a claim after damage occurs, adjusters inspect the loss, and then your insurer decides how much you’re owed. It’s reactive, time-consuming, and often disputed.

Parametric insurance, on the other hand, doesn’t wait for all that. Instead, it pays out automatically when a predefined event happens. For example:

The payout isn’t based on actual loss verification but on triggers, measurable parameters like weather data, seismic readings, or rainfall indexes. That’s why it’s called parametric insurance.

It’s fast, transparent, and removes much of the back-and-forth that is slowing down traditional insurance right now.

Now, here’s where things get exciting.

Adding blockchain technology to parametric insurance makes it even more powerful. Using smart contracts, insurance payouts can be fully automated. A smart contract is like a self-executing digital agreement that triggers once conditions are met.

So, if satellite weather data confirms a flood in a certain region, the smart contract parametric insurance program on the blockchain instantly releases funds to all affected policyholders. No human approval required.

You get no delays, no waiting for manual approvals. Payouts happen automatically, whenever something goes wrong.

All conditions and transactions are visible on the blockchain, leaving no room for disputes from policyholders or insurance companies.

Policyholders get to have blind trust as they don’t have to “trust” the insurer’s word; the contract executes as coded.

Eliminates paperwork and reduces administrative costs, streamlining the work and bringing reliability to the operations during a dire time.

That’s why parametric insurance blockchain technology is being hailed as one of the most important innovations in digital insurance solutions.

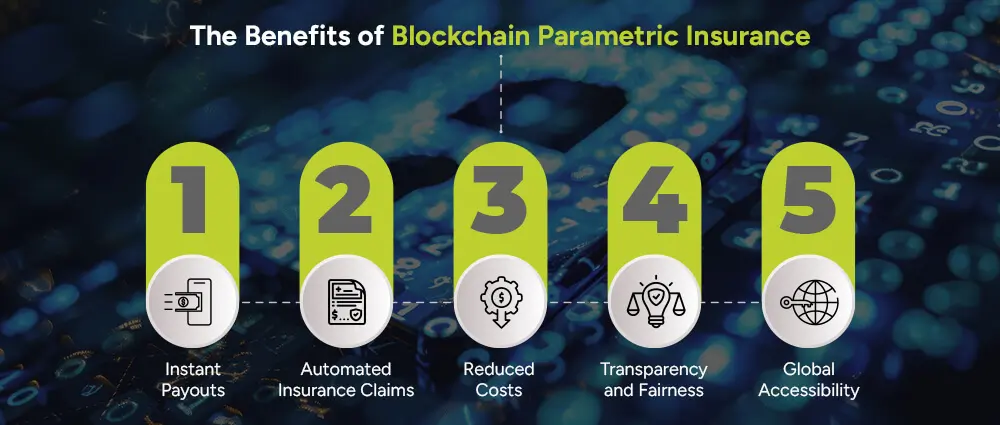

Let’s break down the key benefits in a simple way:

The biggest assurance is an instantaneous insurance settlement. This can definitely change lives of those suffering beyond their control. Farmers are fed with the seeds for the next season, families get home far from disaster zones, and businesses catch up on their operations without being paralyzed due to delays.

Automated insurance claims would eliminate further actions like filing, waiting for adjusters, and settlements. This alleviates the process, rendering it fast and non-stressful.

Fewer intermediaries and administrative costs mean that insurers can lower costs and pass these financial blessings onto the most deserving in terms of policyholders.

Due to the blockchain, the nature of the finances, including the exact data triggers, becomes very clear indeed, utterly decimating disputes. Each one knows right from the start.

With parametric insurance platforms powered by blockchain, insurance can reach underserved regions. Farmers in developing countries, for example, could benefit from blockchain crop insurance that protects them against droughts or floods.

This isn’t just theory, it’s already happening.

Weather events cause billions in damages every year. With blockchain weather insurance, payouts are tied to objective weather data, such as rainfall or wind speed. If the data confirms the trigger, money flows instantly to those affected.

Farmers are among the biggest beneficiaries. Blockchain crop insurance allows them to protect their livelihoods against unpredictable weather. Imagine a farmer in Africa automatically receiving funds after a season of low rainfall, without ever filing a claim. That’s transformative.

For earthquakes, floods, or hurricanes, blockchain ensures automated disaster claims are processed instantly. This helps governments, businesses, and individuals bounce back faster after a disaster.

Businesses in logistics, tourism, energy, and media sectors are also using blockchain parametric insurance benefits. A shipping company, for example, could insure against port closures caused by storms and receive an instant payout when thresholds are breached.

The beauty of blockchain insurance innovation lies in how it enhances trust and automation.

In traditional insurance, trust depends on intermediaries. You trust the insurer, the adjuster, and even the reinsurance company. In blockchain parametric insurance, trust is transferred to code and data.

Smart contracts automatically verify whether the event occurred using trusted data sources like satellites, sensors, or meteorological agencies. Once verified, the payout is triggered instantly.

This eliminates the risk of fraud, mismanagement, or delay.

Of course, no system is perfect. For all its promise, parametric insurance blockchain technology still faces some challenges:

The system depends on reliable data sources. If data is faulty or manipulated, payouts could be unfair. So, data integration with blockchain is quite useful.

Sometimes, policyholders may suffer losses even though the parametric trigger wasn’t met (for example, a farmer whose field is flooded but rainfall didn’t cross the set threshold). This mismatch is called basis risk.

Insurance is heavily regulated, and blockchain-based solutions may face compliance challenges across different countries.

While the idea is strong, widespread adoption requires education, infrastructure, and trust in digital systems.

Despite these challenges, the momentum is undeniable. Many insurers, startups, and global institutions are already testing and rolling out parametric insurance platforms using blockchain.

We’re standing at the edge of a revolution in the insurance industry. Natural disasters are increasing in frequency and severity due to climate change, making fast financial recovery more important than ever.

Blockchain parametric insurance is not just a new product, it’s a shift in how insurance is designed, delivered, and trusted. It’s an example of how digital insurance solutions can close the gap between disaster and recovery.

From protecting farmers’ crops to helping small businesses survive storms, from covering entire communities to ensuring governments can respond quickly, this model has the potential to reshape global disaster response.

See how Arpatech can shape the emergency landscape and help in fast and efficient disaster recovery. Get insurance plans that are automated and software that don’t require attention, automate your recovery to get back on your feet as fast as possible.

Blockchain ensures automation, transparency, and trust. With smart contracts, payouts are executed instantly once conditions are met. This removes human delays, reduces fraud, and builds confidence in the system.

Carriers should watch for basis risk (when losses don’t perfectly match triggers), data reliability (ensuring sensors and weather stations are accurate), and regulatory compliance across different markets.

The strongest early use cases are in weather-based risks such as drought, flood, and hurricanes. That’s why blockchain weather insurance and blockchain crop insurance are already being tested widely. These areas have clear, measurable parameters and deliver high value to communities most vulnerable to disasters.