Open banking is no longer just a regulation-driven project. With the right Open Banking Strategy, it has become a way for banks, fintechs, and businesses to create better services, cut costs, and open new revenue streams.

At its heart, open banking is about data sharing and API integration, letting customers safely connect their financial accounts with apps and services they trust. This shift is building collaborative ecosystems where financial services become more flexible, customer-friendly, and innovative.

Open banking allows customers to give permission for their financial data to be shared securely with other apps or platforms.

For example:

A budgeting app can pull in your bank transactions to give you a full money overview.

A shopping website can let you pay directly from your bank account, skipping the need for a card.

This happens through API integration, which acts as the secure “bridge” between different financial services. The rules for this come from regulatory frameworks such as PSD2 in Europe.

So in short, open banking = safe data sharing + clear customer control + modern financial services.

Open banking adoption is growing quickly:

The UK has already passed 15 million open banking users, with payments being the most popular use case.

Globally, the number of open banking API calls is expected to grow by over 400% by 2025, showing how fast businesses are building on these rails.

This growth proves customers are ready, and businesses are finding real value in payment innovation, lending, and financial insights.

A good Open Banking Strategy starts with customer needs, not just technology. Here are the main steps:

Look at where customers struggle, slow onboarding, high payment fees, rejected loan applications, and design solutions that fix those pain points.

Data sharing must be secure. That means encryption, clear consent, and giving customers control over when and how their data is used.

With smart API integration, businesses can launch faster while staying safe. Keep systems modular so you can add or change partners without starting from scratch.

Work in collaborative ecosystems

Open banking works best when banks, fintechs, and merchants team up. These partnerships drive faster growth and better experiences for customers.

One of the fastest results from open banking is payment innovation. “Pay by bank” services allow customers to pay directly from their bank account instead of using a card.

This is why payment is often the first step in any Open Banking Strategy.

Open banking also transforms how financial services are delivered through data sharing:

Rather than wait days for micro-deposits to verify an account, one can merely log onto their bank, and it’s done instantly.

Lenders are able to assess cash flows in real-time to approve loans and include customers who are previously left out. This is a way of ensuring that there is financial inclusion.

Apps will know more about a personalized savings tips, personalized spending insights, or even personalized investment nudges that may be thrust upon the customer based on what they would have done as behavior.

This is where open banking moves beyond payments and creates new business models.

Businesses are using open banking to launch new business models that generate revenue and customer loyalty:

With consent, businesses can turn transaction data into insights, like income verification for loans or expense tracking for budgeting.

E-commerce platforms and apps can add loans, insurance, or savings features without becoming banks themselves.

Small businesses can pay for tools like automated reconciliation, instant payouts, or cash flow dashboards.

Companies that aggregate bank connections can charge developers or partners for access, support, and premium features.

Each of these models builds on safe API integration and clear regulatory frameworks.

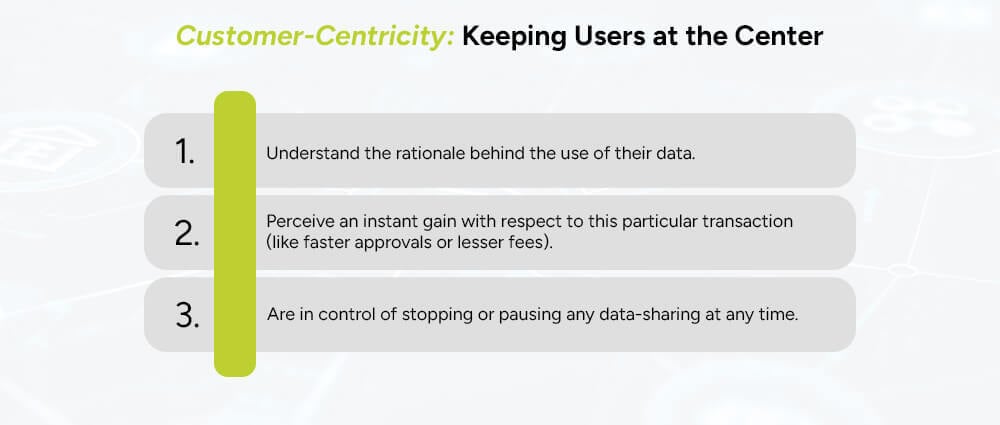

There are two things an Open Banking Strategy must do: customer-centricity. Customers consent to data-sharing only if they:

Putting transparency and control in the hands of the user creates trust and enhances long-term loyalty.

Regulations may seem like a burden, but they create the foundation for trust. Regulatory frameworks ensure:

By treating compliance as part of product design, companies can move faster and stand out as trustworthy.

Open banking thrives on collaborative ecosystems. No single player can cover everything; banks, fintechs, merchants, and technology providers need each other.

Working together, they create financial services that are faster, cheaper, and more customer-friendly.

One of the most powerful benefits is financial inclusion. With real-time data sharing, people who don’t have long credit histories can still prove their reliability through income and spending records.

For example, a small business with steady cash flow but no collateral can get credit through open banking-powered assessments. This helps underserved groups participate more fully in the financial system.

Many businesses ask: how do we earn money from open banking? The answer often lies in data monetization.

With consent, transaction data can be enriched and sold as insights, for example, risk scoring, spending categorization, or loan decision signals. The key is to ensure that customers also see value, so the exchange feels fair.

This creates a win-win: businesses generate income, while customers get faster, more relevant services.

Open banking is no longer only about compliance; it’s about opportunity. With the right Open Banking Strategy, secure API integration, and customer-first design, businesses can now adapt new business models, expand financial inclusion, and create real value through payment innovation and data monetization.

By building strong collaborative ecosystems and working within clear regulatory frameworks, financial services can evolve into something smarter, faster, and more human. This is where Arpatech can help by guiding you through strategy, building secure integrations, and creating scalable digital solutions that turn open banking into real business growth.

Through encryption, tokenization, and secure API integration. Customers should always be in control of what data is shared and for how long. Strong regulatory frameworks also provide protection.

The biggest challenge is aligning incentives. Banks pay for the infrastructure, but fintechs and merchants often see the most benefits. Clear partnerships and shared revenue models in collaborative ecosystems help solve this.