Insurance firms have always been about balancing risk, speed, and trust. Lately, there’s a new teammate on the floor: artificial intelligence. When layered into existing systems as AI in insurance operations, it becomes a force multiplier, streamlining manual work, improving customer service, and helping underwriters and claims teams make sharper decisions.

Today, I’ll walk you through practical ways AI is used right now, why it pays off, and how teams can start without getting lost in the buzzwords.

Think about the repetitive, rule-based tasks that gobble up hours every day: opening claims, verifying documents, filling forms, routing policies for signature. That’s exactly the kind of work intelligent automation handles best. By automating routine flows, insurers free people for judgment-heavy tasks, the ones where nuance, empathy, and experience still beat a model.

Two sources that tell the story:

In a 2024 McKinsey survey, about 65% of respondents said their organizations were regularly using generative AI, a sign that insurers aren’t just experimenting; they’re deploying AI in production.

A recent NAIC survey found that 84% of health insurers report using AI/ML in some capacity, showing broad, real-world uptake in a highly regulated line of business. Those numbers mean what you think: AI isn’t hypothetical. It’s driving process optimization and cost reduction now.

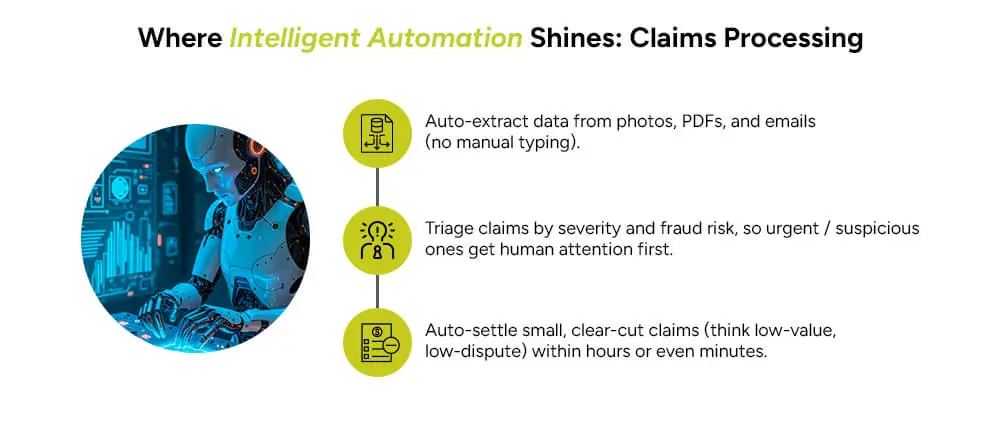

Claims are a prime target. The typical lifecycle, intake, validation, estimate, and settlement, has many hand-offs and document-heavy steps. AI can:

That combination speeds up turnaround and reduces back-office toil. Insurers using automated claims flows often report big improvements in cycle time and customer satisfaction because people get paid faster and with fewer hoops to jump through.

Industry analyses have found that automated claims processing can reduce the time to settle by substantial margins.

Underwriting used to mean shuffling paper, hunting for prior-loss history, and slow manual scoring. Now AI and predictive analytics change the game:

That’s underwriting automation: faster quotes, more consistent risk selection, and, most importantly, better alignment between premium and risk.

Policy admin (endorsements, renewals, cancellations) is ready for robotic process automation plus AI:

All of this reduces processing time and human error, and supports cost reduction without sacrificing service levels.

Predictive analytics isn’t only for pricing. It helps insurers forecast where losses will concentrate (e.g., flood-prone zones, rising claims in a particular product), decide where to invest in loss control, and design prevention programs for large groups of policyholders. Combine that with real-time data (IoT sensors, telematics) and you move from reactive claims-paying to proactive risk management.

A common fear is that automation will erase human roles. Reality: the highest-value outcomes come when AI does the heavy lifting and humans apply judgment. For example:

This is where you get the most durable ROI: people doing what only people can do, machines handling the rest.

Insurers operate in regulated environments. That means any AI system must be auditable, explainable, and fair:

This is not just compliance theater; it improves models and builds trust with regulators and customers.

AI reduces cost in multiple ways: fewer manual hours, fewer mistakes, faster settlements (which reduces legal and administrative drag), and better risk selection. But the fastest, most reliable ROI usually comes from operational efficiency projects, automating repetitive workflows and claims triage, rather than attempting to replace core actuarial judgment overnight.

BCG and other consultancies have noted that customer service and automation often account for a large share of early AI-generated value in insurers.

AI adoption in insurance isn’t without hurdles. But most challenges have practical solutions that help insurers move forward with confidence.

Claims, underwriting, and customer data often sit in separate systems, limiting AI’s effectiveness. Centralized data stores or APIs can break down these walls and improve accuracy.

Old platforms can’t be replaced overnight. Integration layers and gradual migrations let insurers connect AI to existing systems without major disruption.

Underwriters and adjusters may lack AI know-how. Upskilling teams with basic AI literacy and adding a small data/ML ops group bridges the gap.

AI must stay transparent and compliant. Early frameworks for logging, bias checks, and human oversight keep operations safe and trustworthy.

These challenges may seem daunting, but with smart planning, they become stepping stones. By tackling silos, legacy tech, skill gaps, and governance, insurers can unlock the real benefits of AI in insurance operations, smoother workflows, lower costs, and stronger customer service.

Cycle time drop, if time-to-claim resolution or quote-to-bind falls significantly, automation is working. Many insurers report substantial reductions once automation is in place.

Worker redeployment, if back-office staff shift from data entry to exception-handling, you’ve moved from cost-cutting to capability-building.

AI-driven automation is a practical lever for insurers who want faster operations, lower costs, and better customer experiences. Start small, govern carefully, and design for collaboration between machines and people; that’s the formula for seamless insurance operations.

At Arpatech, we help insurance providers put these ideas into action by building personalized AI development solutions, streamlining claims and underwriting workflows, and ensuring compliance is never compromised. If you’re ready to transform your operations with intelligent automation, our team can guide you every step of the way.

Immediate returns tend to occur in areas that provide sittings on high-volume and low-complexity operations: claims intake and triage, document extraction, policy administration, and simple underwriting decisions. The beauty of AI here is that it quickly eliminates manual hours, reduces cycle times, and lowers error rates-an excellent demonstration for measurable returns.

The essence of the AI within insurance companies is governed clearly: controlled versions of models are used with logs of decisions made, with tools for explainability, tests for bias, data privacy fully enforced, and human-first oversight of any significant decisions. Achieving regulatory engagement and documenting what goes into and comes out of a model enhances applicable standards and guidelines for AI use.

Not now, at least for the near-term. AI takes care of the repetitive parts of the job but actually supports real-time decision-making. The human expert is still extremely important, where the judgment call is complex, where relationship management enters, or where exceptions need to be handled. In all likelihood, we will see an evolution of the roles: colleague decision-making or strategic work to humans, while computers will carry out rule-based execution.

Start with the cleanest data that will give you the largest impact: claims history, policy metadata, customer contacts, and most-used forms/documents. For underwriting in particular, exposure data and loss history are key. Even if the data is not perfectly clean, run a pilot under minimal requirements to narrow down the use case and iterate toward better data quality.