Insurance lives and dies on trust. Policyholders trust carriers to keep accurate records, pay legitimate claims, and protect sensitive data. Insurers trust each other, brokers, and regulators to be honest and auditable. Insurtech, technology that modernizes insurance, has already changed how companies price risk, process claims, and serve customers. But one of the most powerful tools in the insurtech toolbox for strengthening data integrity is blockchain.

Below, we’ll walk you through, in plain language, how blockchain adds real value for insurers: from immutable records and smart contracts to fraud prevention, claims automation, and meeting regulatory compliance needs. We’ll use simple examples, touch on practical limits, and close with answers to the most common questions.

At its simplest, data integrity means data you can trust: complete, accurate, tamper-evident, and auditable. For insurance, that means:

Traditional systems store this data in centralized databases. That works, but it creates single points of failure, reconciliation headaches when multiple parties are involved, and opportunities for fraud or accidental changes.

A blockchain (or distributed ledger) is a shared database where transactions are recorded in an append-only chain of blocks. Two important features for insurance are:

When insurers, reinsurers, brokers, hospitals, and regulators agree to share certain data on a permissioned ledger, everyone gets the same view of truth. That’s hugely helpful for transparency, digital trust, and risk management.

Blockchain helps data security in three practical ways:

Edits to records are visible because each new block references the previous one. If someone tampers with old data, the chain won’t validate across the network.

Entries are cryptographically signed, so you can cryptographically verify who added what and when.

With permissioned blockchains, multiple trusted parties host nodes, reducing the risk that one compromised system ruins the whole dataset.

Put together, these features create immutable records that auditors and regulators can rely on. That’s not the same as making everything public; permissioned ledgers can still restrict who sees what while preserving integrity.

One thing to remember: blockchain strengthens integrity but does not replace the need for good access controls, encryption of sensitive fields, and secure key management.

One of the most practical Insurtech applications is combining blockchain with smart contracts, small programs that run on the ledger and execute when preset conditions are met.

Imagine a travel delay policy: if flight delay data (from a trusted oracle) shows a qualifying delay, a smart contract automatically triggers a claim payment to the policyholder. That’s claims automation with fewer manual steps, fewer disputes, and faster payouts.

Smart contracts must be carefully written and tested; bugs here can cause wrong payouts or stuck claims, so governance and fallback processes are critical.

Fraud is responsible for costing insurers billions every year. Blockchain will discourage such fraudulent acts by making it easy to spot duplicate claims, staged events, or inconsistent histories:

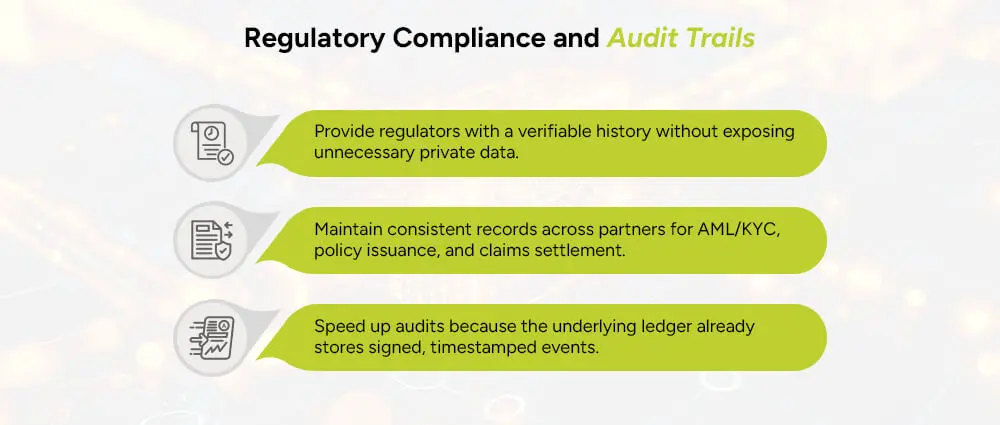

Regulators want clear, auditable trails. Blockchain naturally supports auditability by recording who did what and when. Permissioned ledgers make it possible to:

This doesn’t remove the need for legal and compliance teams, but it streamlines audits and improves regulatory compliance readiness.

Some real-world use cases that benefit most:

Industry research also shows growing interest: market forecasts project strong growth in blockchain use within insurance, as companies invest in verification, reconciliation, and automation tools. For example, one market analysis projects the blockchain-in-insurance market to expand significantly over the coming years. Many insurance firms report plans to increase blockchain investment as they target claims automation and fraud prevention.

Blockchain isn’t a silver bullet. Here are practical limits to consider:

Good implementations mix blockchain with proven engineering practices: off-chain storage for heavy or private data, signed hashes on-chain for integrity, and clear legal agreements among participants.

Technology alone doesn’t create trust; people do. Blockchain is a tool that makes it easier to prove things to customers, partners, and regulators. Pair it with transparent governance, strong security practices, and user-friendly interfaces, and insurers can deliver real digital trust to customers.

To successfully implement blockchain, insurers should identify various applications but zero in on a high-value, focused use case for entering the blockchain space, such as claims handling. Sensitivity regarding information requires using permission ledgers, which enable storing on-chain only cryptographic proofs. Key elements needed for success include strong governance, reliable identity framework, trusted data oracle, but above all, a pilot with key partners like brokers, reinsurers, or hospitals to get the real value out of network collaboration.

At Arpatech, we help businesses navigate this journey by designing blockchain solutions tailored for insurance, ensuring data integrity, regulatory compliance, and seamless integration with existing systems, so you can build trust, reduce risk, and innovate with confidence.

It stores signed, timestamped entries in purely append-only ledgers, rendering records tamper-evident and readily verifiable by various parties. In combination with on-chain hashes and off-chain secure storage for private data, one can obtain both privacy and integrity: the ledger proves, without revealing any sensitive content, that data did exist at a certain state.

Yes, they really do. The audit trails created by blockchains show who has entered data and the time. Permissioned ledgers allow insurers to build access for regulatory purposes to verifiable data without publishing customer details publicly. That gives rise to faster audits and lesser work during reconciliation. It should be noted that it must be supplemented with proper governance and privacy practices to be able to satisfy legal requirements.

Top beneficiaries include: