Banks live in a world of rules. New laws, updated guidance, and shifting supervisory expectations arrive constantly, and when compliance slips, the fallout can be reputational, financial, and operational. Enter the Rise of RegTech Automation: a wave of technology designed to make compliance faster, smarter, and less error-prone.

Today, we’ll learn about what RegTech is, why RegTech automation matters for banks, current trends, practical use cases, and clear steps to implement RegTech and compliance automation, all in plain language.

Put simply, RegTech (regulatory technology) is the practice of using software, data tools and automation to help regulated firms meet rules and report to regulators more efficiently. Instead of copying and pasting spreadsheets or hunting for buried documents, RegTech Automation tools automate the repetitive parts of compliance.

These repetitive parts could include: monitoring rules, screening transactions, checking customer identities, preparing reports, and flagging suspicious activity. Think of it as “compliance on autopilot”, but with human oversight.

The continual transformation of regulations is a constant factor. Banks have to monitor and keep track of hundreds or even thousands of rule changes, which can be local or from different jurisdictions. Change is one of the main causes for the speed of RegTech automation development in the financial industry: companies need instruments that not only can be used for provision of regulatory updates but also can convert them into operational rules for systems and personnel.

Regulatory intelligence sources actually pointed out the number of alerts and updates that compliance teams are required to handle, and this indicates the necessity of automation.

Concurrently, the RegTech market is flooding with new entrants, which means the capability of vendors and the amount of investments are maturing so that large and small banks can easily adopt the solutions. The latest market research estimates the global RegTech market value to be in the billions, thus indicating rapid growth and strong demand.

Regtech compliance automation is the subset of RegTech focused specifically on automating the compliance lifecycle: rule ingestion, policy mapping, customer due diligence, transaction monitoring, sanctions screening, reporting, and audit trails. Good compliance automation does three things well:

Put together, these capabilities reduce regulatory risk and free compliance teams to focus on judgment-heavy work rather than rote tasks.

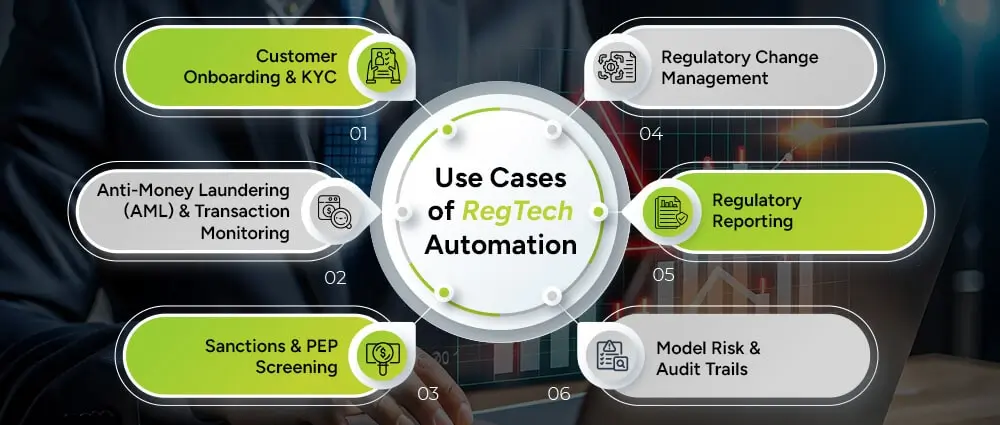

Here are some examples where regulatory technology is commonly used and you see RegTech automation in action every day:

Automated identity checks, document validation, and risk scoring speed up onboarding and reduce false positives.

Machine learning models analyze flows and flag suspicious activity for investigation.

Real-time screening against global sanctions lists and politically exposed persons (PEPs) databases using RegTech automation .

Tools that automatically ingest new rules and map them to internal policies and controls.

Automated assembly of required reports (e.g., liquidity ratios, large exposure reports) into regulator-ready formats.

Systems that version and validate compliance models and keep immutable logs for audits.

These Use Cases of RegTech Automation aren’t theoretical, banks are already deploying them to shrink investigation times and improve detection rates. Academic and industry studies report improved AML performance after adopting RegTech solutions

Here are some Regtech Trends to follow when it comes to enabling better and quicker compliance.

AI improves detection but regulators demand explainability. Expect tools that balance predictive power with transparent reasoning.

Cloud-native, subscription models lower the barrier to entry, small banks can now access enterprise-grade capabilities.

Move from batch checks to live monitoring so issues are flagged before they become breaches.

RegTech automation products are integrating with core banking systems and data lakes via APIs for smoother data flow.

Consolidated regulatory intelligence: Vendors provide curated, machine-readable regulatory updates to feed rule engines automatically.

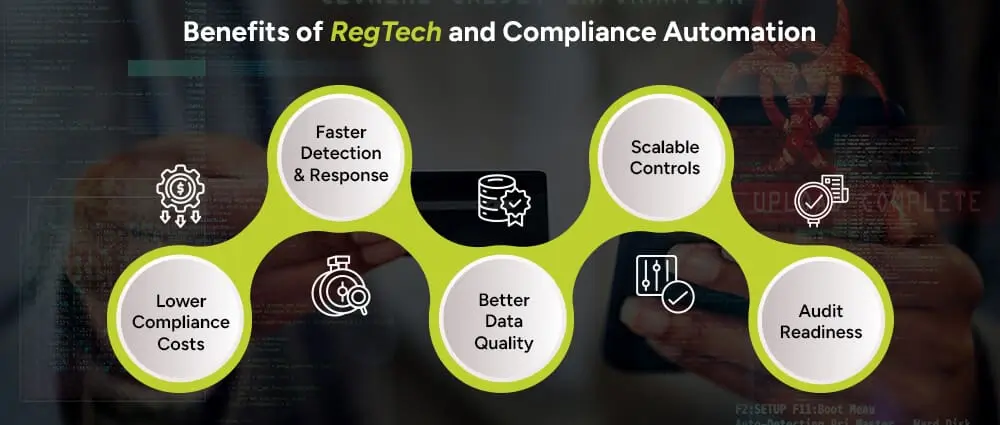

Now, let’s talk about what benefits banks are getting from using Regulatory Technology and Compliance Automation:

Automating mundane tasks reduces headcount needs for repetitive work and minimizes expensive regulatory fines.

Real-time screening means suspicious activity is investigated sooner.

Automated pipelines reduce manual errors and standardize reporting.

As banks expand into new markets, automated controls scale far more easily than manual teams.

Immutable logs and versioned rules streamline audits and regulatory requests.

These benefits compound: better detection reduces loss, fewer manual errors shrink fines, and faster reporting strengthens regulator relationships.

If your bank is considering automation in RegTech, here’s a pragmatic roadmap:

Identify the highest-impact regulatory risks (AML, sanctions, data privacy, capital reporting). Focus automation on areas with the largest exposure.

Map where the data lives, its quality, and how systems talk to each other. Automation needs clean inputs.

Prefer solutions with open APIs and modular features (screening, monitoring, reporting). This supports phased rollout and reduces vendor lock-in.

Run a small pilot against a defined use case (e.g., sanctions screening). Measure false positive rates, investigator time saved, and integration effort.

Ensure models and rules have governance: version control, validation, and human-in-the-loop review. For AI, prioritize explainable outputs for auditors.

Upskill investigators and compliance staff to work alongside automation, their judgment transforms flagged cases into decisions.

Once the pilot shows results, scale to additional products and regions while monitoring outcomes closely.

These Steps to Implement RegTech and Compliance Automation keep the program manageable and aligned with regulatory expectations.

The global RegTech market is rapidly expanding and was valued at roughly USD 15.8 billion in 2024, reflecting strong demand for compliance automation tools.

At Arpatech, we help banks turn the promise of regtech compliance automation into production value. Here’s how we work with clients:

If you want to reduce false positives, shrink investigation times, and demonstrate stronger controls to regulators, Arpatech can build a practical, stepwise program that delivers measurable risk reduction.

Regulatory pressure on banks isn’t going away. The Rise of RegTech and automation in RegTech give financial institutions the tools to meet that pressure intelligently.

When executed properly, the implementation of RegTech automation and compliance automation can lead to significant cost reductions, faster detection, improved data quality and reduction of the pain associated with audits. Start with the most risky processes, validate with pilot, and scale up, all the while maintaining explainability and governance as top priorities.

A partner, like Arpatech, with the right qualities (and a suitable roadmap) transforms compliance from a cost center into a competitive advantage.

Let’s collaborate on your next project!

Absolutely. FinTech is short for financial technology and it is the one that usually thinks about betterment of existing financial services or even the creation of new ones such as payments, lending, personal finance, trading and so on. RegTech on the other hand is the one which mainly deals with the regulatory and compliance issues and it helps banks and other institutions that are regulated to adhere to the rules, give reports to supervisors and manage the risk of regulation. There is a bit of overlap (the FinTechs often make use of the RegTech modules) but the difference in the main goal is very clear: FinTech is the one developing the financial products which are for the customers, it also offers FinTech security; RegTech is the one securing the firms and making sure that they comply.

RegTech’s role is to completely automate and to bring about the highest levels of efficiencies in the compliance processes of banking departments across systems such as onboarding of customers, screening for sanctions and anti-money laundering (AML), monitoring of transactions, mapping of regulatory changes to imposition controls in housekeeping and the generation of ready-to-present-reports for regulators. The bottom line is that RegTech minimizes the regulatory risk, enhances operational efficiency, and provides records that can be audited and thus make the interaction with regulators smoother and quicker.