If you’ve been keeping up with the world of finance and technology, you already know that fintech payment solutions are changing the way we handle money. But this is really thrilling: digital wallets do not really just pay bills for you, or tap your phone at the register to buy a cup of coffee, or have friends split a bill with you. They are quite steadily evolving into powerful tools that go way beyond payment solutions.

Today, digital wallets are at the very base of a transformation that can be anything from real-time payments to open banking and mobile banking experiences. These tools will take businesses, consumers, and even states toward a new level in their journey toward innovation in the payment arena.

Here, we’ll explore how digital wallets are redefining financial ecosystems, why they matter to industries outside traditional finance, and what the future holds for them.

When people first heard about digital wallets, most thought of them as a simple alternative to credit cards or cash. Apple Pay, Google Wallet, and PayPal dominated the scene, showing us how easy it could be to complete transactions digitally. But now, digital wallets are turning into something much more: lifestyle companions.

Think about it: today, your wallet can hold not just money but also loyalty points, airline tickets, event passes, and even your digital ID. Instead of being just a transaction tool, it becomes your gateway to everyday experiences.

One of the most groundbreaking changes digital wallets bring is real-time payments. No more waiting hours or days for money to show up in your account. Whether you’re sending money across borders or paying a freelancer in another country, digital wallets make it instant.

According to Statista, the global transaction value of digital payments is expected to reach $14.79 trillion by 2027. This number reflects just how big the demand for fast, convenient, and reliable solutions has become.

For businesses, real-time payments through digital wallets mean better cash flow and smoother supply chains. For consumers, it’s about speed and trust; you know your money will arrive when you need it.

Another way digital wallets are availing one of the integrations applications in collaboration with mobile banking. Banks do not suffice in holding your funds only, but actually contest against one another to create more seamless tech-enabled experiences.

Suppose this application allows you to log into your bank account, view your digital wallet’s remaining balance, transfer funds instantly, and explore personalized financial advice all in one place. Customers enjoy it, and banks remain relevant in this fintech world.

Just look at the numbers: mobile banking, in 2024, was adopted for use by more than 55% of the people in the U.S. You take that and add in growth figures from digital wallets, and one gets a good glimpse into the future-much of it connected and mobile-first.

Here’s where things get even more exciting with open banking. At its core, open banking allows financial data to flow securely between banks, enables fintech apps security, and third-party providers. Digital wallets are at the forefront of this revolution.

With open banking, your digital wallet could do things like:

This level of personalization turns digital wallets into financial advisors in your pocket. For businesses, it opens doors to new services, better customer insights, and partnerships with innovative fintech providers.

The beauty of digital wallets is that they’re not limited to financial transactions. Let’s look at how industries outside banking are using them:

Through loyalty rewards and personalized promotions, retailers are incorporating digital wallets into shopping apps. Customers enjoy instant discounts while brands cultivate a stronger bond.

Secure digital wallets enable patients to store insurance information, pay bills, and even handle prescriptions.

Digital wallets eliminate cumbersome routines with boarding passes, hotel check-ins, and car rentals.

Universities are testing wallets for fee payments, ID cards, and access to campus services.

This cross-industry adoption shows that payment innovation isn’t just about money, it’s about convenience and trust across daily life.

If you’re running a business, ignoring the rise of digital wallets isn’t an option. Customers now expect real-time payments, seamless checkouts, and integrations with their favorite wallets. By offering these options, you:

And here’s the twist: businesses that adapt to payment innovation early don’t just survive, they thrive. They attract younger, tech-savvy customers while streamlining internal processes.

This is exactly where our digital software solutions come in. We help businesses create, integrate, and scale digital wallet experiences personalized to their industry. Whether you need a custom wallet for retail, a mobile banking upgrade, or an open banking integration, we’ve got the expertise to make it happen.

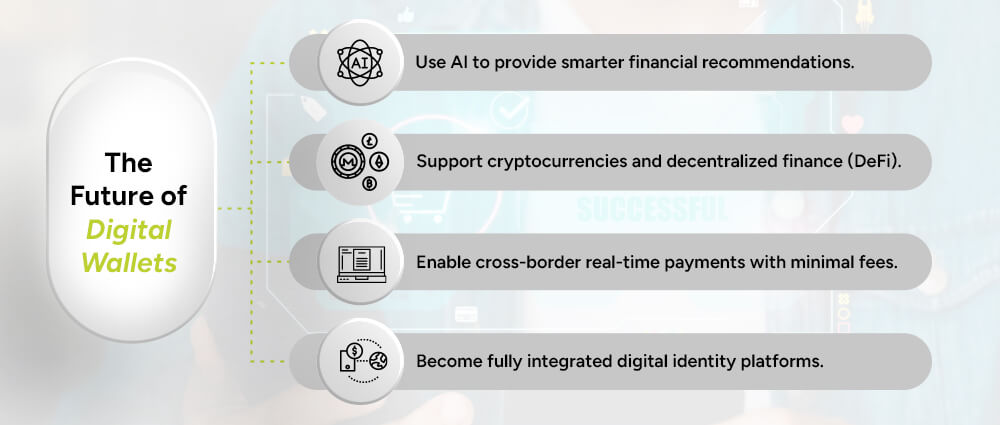

So, what’s next for digital wallets? The possibilities are endless. We’re moving toward wallets that:

The line between finance and everyday life will blur even further. Soon, your digital wallet won’t just handle money; it’ll manage your entire digital existence.

Digital wallets are no longer just about making quick payments at the grocery store. They’ve evolved into dynamic ecosystems that combine fintech payment solutions, mobile banking, real-time payments, open banking, and payment innovation.

For businesses, this means a chance to get ahead by offering customers smarter, faster, and more connected experiences. For consumers, it means more control, convenience, and trust.

If you’re ready to explore how digital wallets can transform your business, at Arpatech, our digital software solutions are here to guide you every step of the way. Let’s shape the future of payments together.

A digital wallet payment refers to payments done using an electronic gadget, usually a smartphone, which stores securely the payment data for credit cards, debit cards, or bank accounts. This method permits fast payment with little hassle of carrying actual cash and cards.

Convenience is the greatest benefit. You can pay instantly, track your expenses, and even have a place to store your rewards or tickets-all in the same secure place.

The next-generation payment solutions symbolize a revolution where real-time payments, sharing banking APIs, AI-enabled customization, and digital wallets are implanted with one another to offer a more progressive, safe, and smart financial experience.

Payments edition of the future headlines in digital wallets, integration with mobile banking, real-time payments, open banking functionalities, and blockchain-performance-powered transactions. These technological wins are revolutionizing debentures in tomorrow’s finance from various domains.