If you’ve ever filed an insurance claim, you know the drill: forms, back-and-forth emails, waiting for verification, then waiting some more for payment. In 2025, that experience is getting a serious upgrade. The catalyst? blockchain smart contracts insurance solutions that bring automated claims processing, trust, and transparency to every step.

Think of a smart contract as a tiny program that lives on a blockchain. It holds the rules of your policy (what’s covered, how much, under what conditions) and it can automatically run those rules when certain events happen. Instead of humans pushing paper, software enforces the policy. The result is blockchain claims automation that shortens timelines, reduces disputes, and helps carriers scale efficiently.

Let’s unpack how it actually works, and where it’s already making a difference.

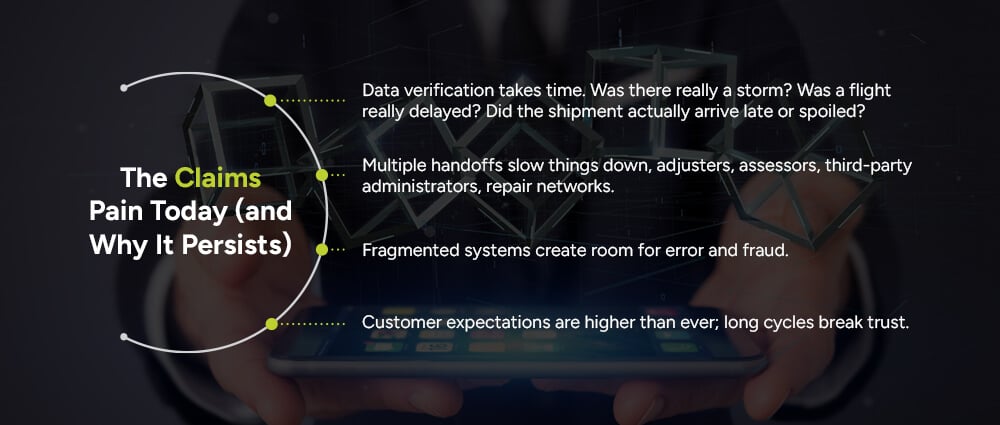

Modern insurers have invested heavily in digital claims management, but there are still friction points:

To calibrate the challenge, consider one current benchmark: J.D. Power reported that U.S. auto repair cycle times during 2024 averaged 18.9 days later in the fielding period, down from 23.9 days earlier, but still weeks of waiting for many customers.

That context matters: any insurance technology innovation that can shave off verification time, automate payouts, and remove redundant steps is a big win.

A smart contract is basically the policy logic turned into code and deployed on a blockchain. Here’s how that changes the game for digital insurance transformation:

The rules you see in your policy PDF, deductibles, coverage limits, and exclusions, become program logic. If X happens and the evidence meets condition Y, the contract triggers outcome Z. This is insurance process optimization at its core.

Smart contracts don’t guess. They wait for cryptographic proof or reliable data from oracles (secure data bridges) to confirm an event. This is the backbone of blockchain claims verification.

Once the trigger is verified, the contract can initiate automated insurance settlements: releasing a payment, notifying a bank, sending instructions to a repair partner, or updating the claim’s status. Human intervention is reserved for exceptions.

Every decision step is recorded, so disputes drop and compliance is easier. Auditors can confirm what happened, when, and why.

The upshot: true blockchain insurance efficiency. Less back-and-forth, fewer manual checks, faster decisions, and consistent outcomes.

Smart contracts shine brightest in smart contract use cases insurance, where the loss event is objective and data-driven. That’s why parametric products, policies that pay when a measurable trigger occurs, have become the poster child for blockchain claims automation.

These are high-fit use cases because the truth lives in data, exactly what smart contracts consume.

Here’s the typical flow for smart contract implementation insurance claims:

A data oracle supplies secure, tamper-resistant feeds: weather indices, IoT telemetry, flight times, shipping milestones, mortality records, or verified documents. The contract watches for thresholds.

The smart contract compares incoming data with the policy logic: “Was rainfall under 10 mm for 15 consecutive days?” “Was the shipment temperature above 8°C for more than 30 minutes?” This is the blockchain smart contracts insurance brain at work.

If conditions are met, the contract executes: initiates payment, notifies stakeholders, closes the claim, or triggers a further check. With automated claims processing, settlement can be near-real time for straightforward cases.

Real-world case studies continue to emphasize the role of secure oracles to feed smart contracts with tamper-resistant data, particularly in parametric models where automation is the product.

The benefit to policyholders is simple: speed and certainty. For customers, smart contract insurance benefits show up as:

For insurers, insurance process optimization means lower handling costs and a better experience, all while freeing adjusters to focus on complex claims.

One forward-looking benchmark: McKinsey has estimated that by 2030, more than half of current claims activities could be replaced by automation, a signpost for the industry’s direction and a strong rationale for investing in claims automation now.

You’ll see the earliest and cleanest wins in lines of business with objective data triggers:

As confidence grows, carriers are layering smart-contract elements into traditional indemnity claims too, using blockchain to verify documents, log adjuster decisions, orchestrate vendor steps, and automate partial payments while repairs are underway. That’s hybrid digital claims management in action.

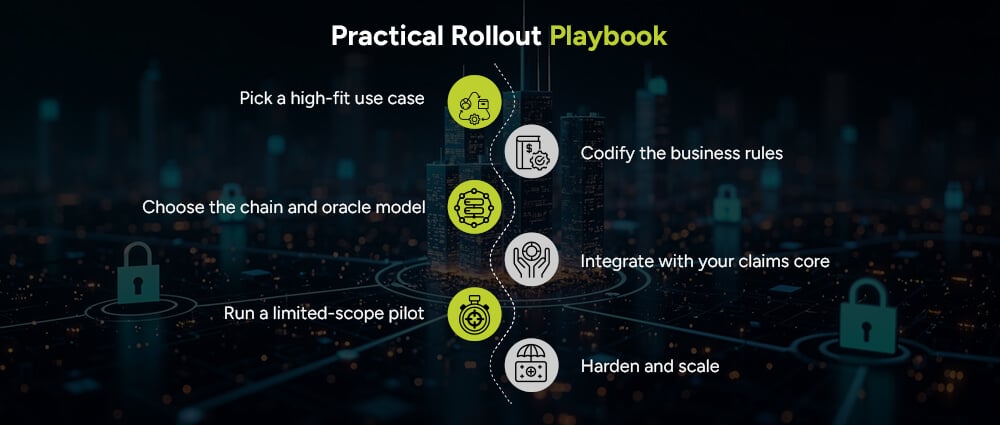

A practical smart contract implementation insurance blueprint usually looks like this:

Critically, none of this requires your entire stack to “move to blockchain.” Most insurers are adding a smart-contract layer that plugs into existing core systems via APIs, an incremental path to digital insurance transformation.

Smart contracts are code, so treat them like critical software:

Done right, GRC becomes a blockchain insurance efficiency driver, not a blocker.

Even with clear benefits, executives want numbers. Here’s how teams justify investment:

Remember our baseline: multi-week auto claim cycles are common today, and projections show large portions of claims activity trending toward automation by 2030. Those two facts alone make a compelling case to pilot blockchain claims automation now.

To make smart contract implementation insurance succeed, keep the rollout focused and iterative:

Parametric travel delay, a weather-indexed cover, or a narrow slice of cargo claims. Keep the trigger objective and the data source strong.

Translate policy text into precise “if/then” logic: thresholds, time windows, locations, deductibles, limits, exclusions.

Permissioned vs. public with privacy layers; single or multiple data oracles; fallback logic for missing data.

Start with read/write APIs to your FNOL intake, document vault, payment processor, and vendor system. Orchestrate events with a lightweight middleware.

Run a limited-scope pilot

Real customers, real payouts, limited geography. Measure speed, cost-to-serve, dispute rate, and customer satisfaction.

Add more data feeds, expand geographies and perils, and introduce hybrid models that automate portions of indemnity claims (document checks, payments triggers at milestones).

By following this path, you’ll turn “innovation theater” into measurable insurance process optimization.

In 2025, smart contracts are moving from concept to core capability. When you strip away the buzzwords, you’re left with something both simple and powerful: policy rules that enforce themselves when trusted data says it’s time. That’s the essence of blockchain smart contracts insurance, and it’s why customers, and carriers, are feeling the difference.

Use cases that leverage objective, third-party data are already delivering results, while more complex claims are gaining automated checkpoints that reduce friction and speed settlements. With only a modest lift to integrate, insurers can unlock faster, fairer, and more transparent claims, exactly what policyholders have wanted all along.

At Arpatech, we help insurers and enterprises bring these innovations to life. From building secure smart contract frameworks to integrating blockchain with your existing claims systems, our team ensures a smooth transition toward digital insurance transformation. Whether you’re piloting parametric covers or modernizing traditional claims workflows, the consultants at Arpatech provide the expertise, technology, and support to make automated claims processing a practical reality for your business.

They automate the busywork. Instead of people collecting and checking evidence step by step, the contract listens for trusted event data (like verified flight delays, weather indices, or IoT sensor readings). When conditions match the policy rules, it triggers actions automatically, like approving the claim or initiating payment. This removes handoffs and compresses cycle time, a major goal of digital claims management and insurance technology innovation.

Common triggers in smart contract use cases insurance include:

Start where proof is objective and coverage is binary: parametric travel, weather-indexed agri, and cargo/IoT-based policies. From there, layer automation into parts of traditional claims: document checks, milestone-based partial payouts, and vendor orchestration. This staged approach delivers early value while you build toward broader blockchain insurance efficiency.