Insurance is built on trust. People pay premiums with the belief that their insurance company will step in during tough times, whether it’s after a car accident, a hospital stay, or damage to their home. But unfortunately, fraud eats away at this trust. Insurance fraud is a growing phenomenon across the globe tolling up dollars in billions every year while raising premium costs for honest customers.

Luckily, new things like Blockchain and Artificial Intelligence (AI) technologies have changed the game really quite well. All of these really powerful technologies are changing the way we detect, prevent, and even eliminate fraud in the insurance industry. Let’s explain how this works and why it matters.

Insurance fraud isn’t just about a few fake claims here and there; it’s a massive global issue. According to the Coalition Against Insurance Fraud, fraud costs the U.S. insurance industry over $308 billion annually. That’s money that could have gone into lowering premiums, improving services, or creating more customer benefits.

Fake medical bills, staged vehicle accidents, padded property claims, or even people taking insurance policies under fraudulent names are all forms of fraud. Every time fraud occurs, the investigator spends considerable time and energy to investigate it, and customers usually feel the consequences through higher costs.

Here is where Insurance Fraud Prevention, Blockchain, and AI step in for insurance fraud detection. Together, they offer transparency, speed, and intelligence that no human investigator can match by themself.

Let us define what the term actually means before digging deep into the nitty-gritty of how blockchain fights fraud.

Blockchain is like digital ledger, or book of records that keeps track of transactions. But here comes the twist: Unlike the traditionally maintained records, blockchain does not exist at one point; it is on many computers; once the information enters it, it cannot be changed or altered.

What does that mean for insurance companies?

So really, a person would think of blockchain as a glass with clear visibility where every action can be traced and traced and locked.

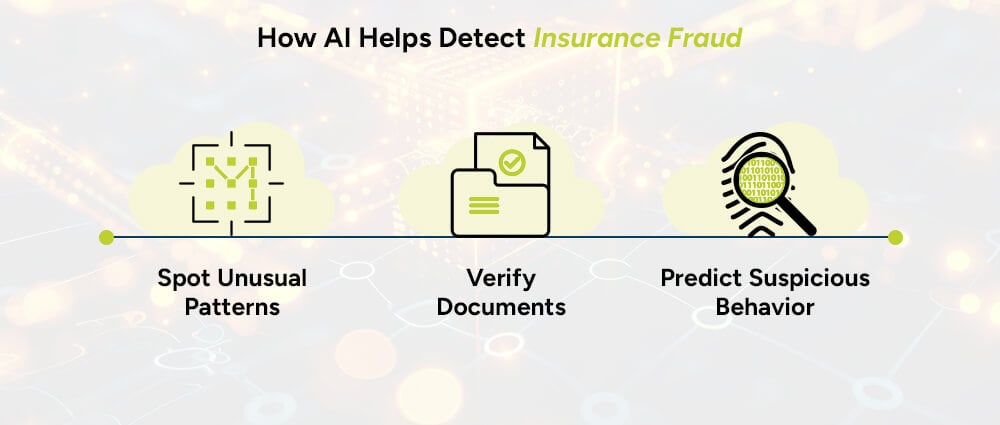

While blockchain locks down data, AI in insurance fraud prevention brings intelligence to the table. Artificial Intelligence thrives on analyzing large volumes of information quickly, something human teams would take weeks or months to do.

AI uses tools like machine learning, natural language processing, and predictive analytics to:

In short, AI works like a detective, always scanning the scene, connecting the dots, and raising red flags where things don’t add up.

Blockchain and AI, when taken separately, are great. Together, however, the two form a chain that cannot be broken when it comes to preventing fraud in insurance.

Here is how they complement each other:

For example: consider a situation wherein one claimant attempts to lodge duplicate claims for the same car accident with two different insurers. Blockchain ensures that both claims are posted on the same ledger and, hence, duplication is quite apparent. Further, AI flags the duplicate instantly and saves both insurers time and money.

Let’s bring this down to real-world scenarios where these technologies are already making a difference.

Fake medical bills are one of the biggest sources of fraud. Blockchain ensures hospital records are securely stored and can’t be altered. AI then checks these records against submitted claims to verify authenticity.

Some fraudsters stage accidents or inflate repair costs. AI can analyze crash photos or repair bills to detect inconsistencies, while blockchain ensures repair shop records match what’s being claimed.

False identities are sometimes used to file fraudulent claims. With blockchain, identity verification becomes foolproof, while AI checks application patterns to catch suspicious submissions.

These examples highlight how risk assessment blockchain systems combined with AI can filter out fraud before it even reaches the payout stage.

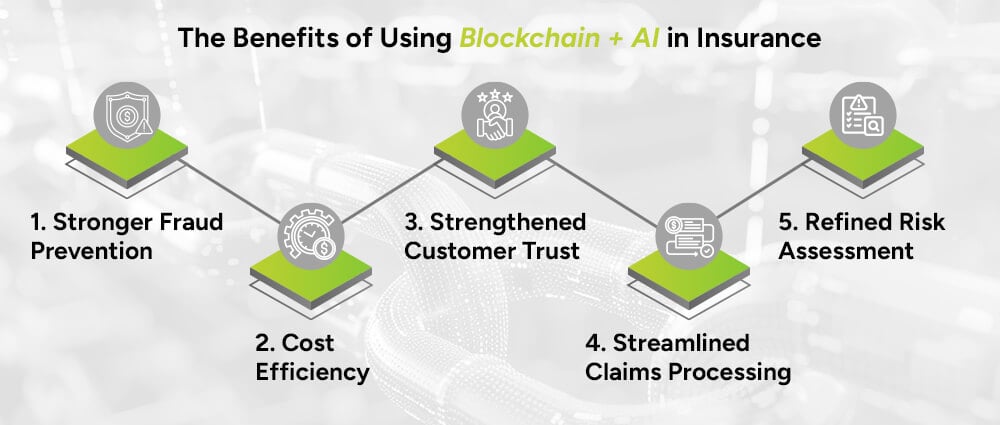

So, why should insurance companies adopt these technologies? Here are some clear benefits:

The combination of blockchain’s tamper-proof records and AI’s ability to analyze data in real time creates an airtight defense system.

Insurance companies are able to save billions in their operations through fraud reduction, which can be channelled to either reduce premiums or uplift the service levels offered to customers.

The customers develop confidence because they believe their data is safe and that their insurer is employing cutting-edge tools to ensure fairness.

From the time that the blockchain holds the accurate data to the validation of the claim down to payment by the intelligent system, the customer no longer has to wait for weeks for investigations.

Risk assessment blockchain systems guarantee that insurers are able to accurately assess those risks by looking at clean and credible data. Fair pricing equates to fewer mistakes.

Of course, like any new technology, adopting blockchain and AI isn’t without challenges.

But despite these challenges, the long-term benefits make adoption worthwhile. In fact, many insurers are already running pilot projects to see how blockchain and AI can reshape their fraud prevention strategies.

The future looks promising. As blockchain networks grow and AI algorithms get smarter, insurance fraud prevention will become more efficient, accurate, and reliable. Imagine a world where fraudulent claims are spotted instantly, honest customers get faster payouts, and insurers save billions every year.

This isn’t science fiction; it’s already happening. In the next decade, blockchain security insurance solutions and AI-driven fraud detection systems will become standard practice across the industry. And that’s where Arpatech comes in, by helping insurers design, build, and integrate customized blockchain + AI solutions, ensuring stronger fraud prevention, better data integrity, and smarter risk assessment for long-term success.

Deception is a disaster, and you need disaster recovery as soon as possible. Blockchain and AI can help prevent several types of fraud, including:

Blockchain ensures that all data is secure, transparent, and tamper-proof, while AI analyzes that data to spot suspicious behavior. In other words, blockchain provides the trustworthy foundation, and AI acts as the smart detective. Together, they create a reliable system for detecting and preventing fraud.

Risk assessment improves because blockchain provides accurate, unaltered records, and AI uses that clean data to predict risks more effectively. For insurers, this means more accurate pricing, better decision-making, and fewer chances of fraud slipping through the cracks.